The Discipline Equation: Why Willpower Fails and What Actually Works for Traders

Master trading discipline with systems, not willpower. Learn the Discipline Equation framework: (Systems + Environment + Accountability) / Friction for consistent rule-following.

Profabighi Capital Research Team

January 2, 2026

Important Notice

This content is provided for informational and educational purposes only. It should not be considered as financial, investment, or trading advice.

You have all the knowledge. You have the strategy. You have the tools.

And you keep breaking your own rules.

Every time you blow through a stop loss, you tell yourself: "I need more discipline." Every time you oversize a position, you promise: "I'll be more disciplined tomorrow." Every time you revenge trade after a loss, you swear: "This is the last time."

It never is.

Many traders believe trading discipline is something you either have or don't have. Some traders are born disciplined. Others aren't. You just need to try harder, be stronger, want it more.

This belief is wrong about everything.

The breakthrough comes when you stop trying to be more disciplined and start building better systems. That's when you discover what we call The Discipline Equation—and it changes everything about how you trade.

The Discipline Myth

Here's the uncomfortable truth that the trading industry doesn't want you to hear: willpower-based discipline doesn't work.

Not because you're weak. Not because you lack character. But because willpower is a finite resource that depletes throughout the day.

Research by psychologist Roy Baumeister showed that willpower works like a muscle. Use it too much, and it gets tired. By the afternoon, after a morning of resisting impulses and making decisions, your willpower tank is nearly empty.

This is why you can follow your rules perfectly at 9 AM and completely abandon them at 2 PM. It's not a character flaw. It's biology.

"You do not rise to the level of your goals. You fall to the level of your systems." — James Clear, Atomic Habits

The traders who appear "disciplined" don't have more willpower than you. They have better systems. They've designed their environment, habits, and accountability structures so that following the rules is the path of least resistance.

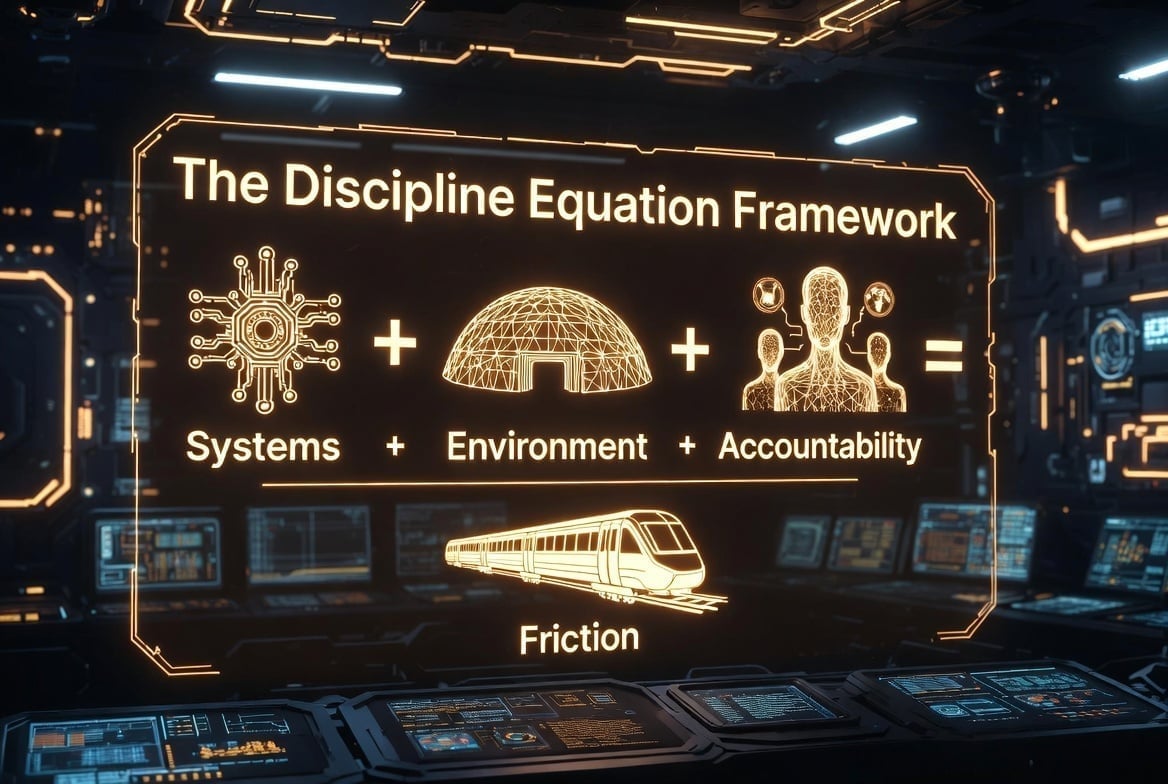

The Discipline Equation Framework

After years of research and application, a framework emerges that finally makes discipline sustainable:

Discipline = (Systems + Environment + Accountability) / Friction

Component 1: Systems

Rules, checklists, and processes that remove the need for in-the-moment decisions. When you have a system, you don't need willpower—you just follow the system.

The Pre-Trade Checklist:

- Does this match your setup criteria? (Yes/No)

- Is your position size within your rules? (Yes/No)

- Do you have a clear stop loss? (Yes/No)

- Are you in a good emotional state? (Yes/No)

If any answer is "No," you don't take the trade. No willpower required.

Implementation Intentions:

Research shows that "implementation intentions" dramatically increase follow-through. The format is: "When X happens, I will do Y."

Examples:

- "When I feel the urge to move my stop, I will close my charts for 5 minutes."

- "When I have 3 consecutive losses, I will stop trading for the day."

- "When I see a news headline, I will wait 30 minutes before trading."

These pre-decisions remove the need for willpower in the moment.

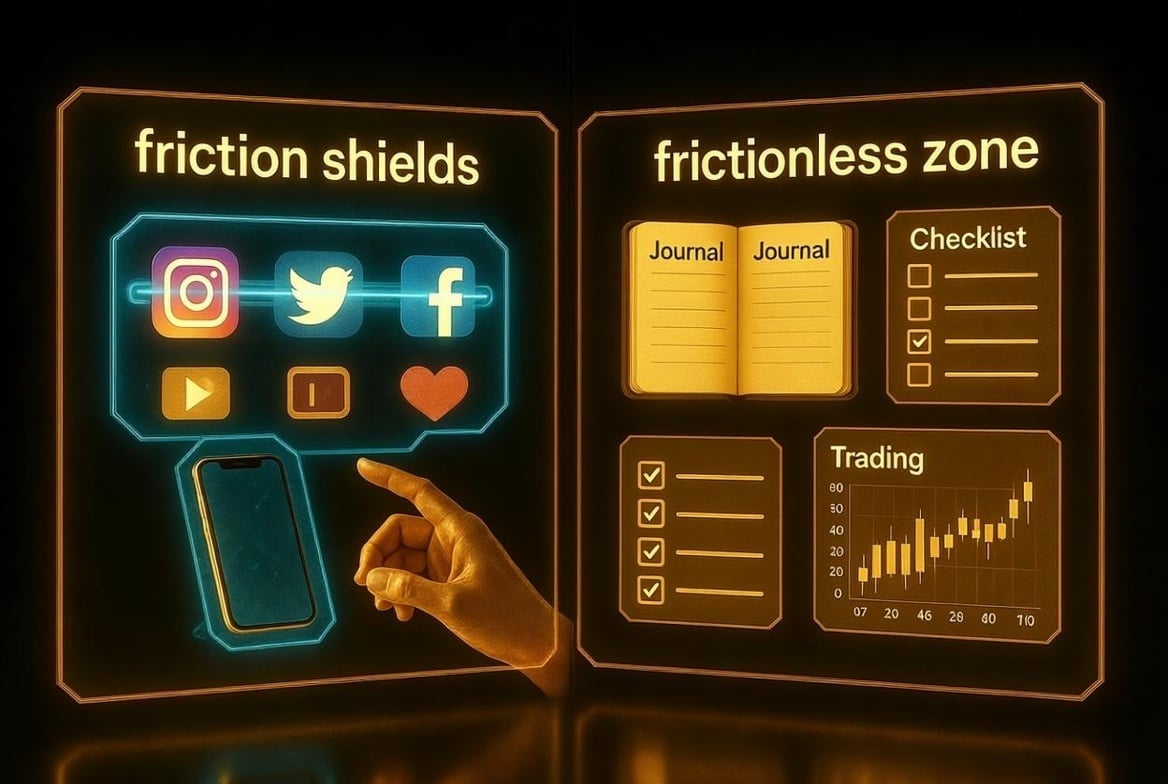

Component 2: Environment

Your environment shapes your behavior more than your intentions do.

Physical Environment:

Remove friction from good habits:

- Keep your trading journal open on your desk

- Have your checklist visible on a second monitor

- Place a water bottle within arm's reach

Add friction to bad habits:

- Log out of social media on your trading computer

- Use website blockers during trading hours

- Keep your phone in another room

Digital Environment:

Notifications are discipline killers. Every notification is an interruption that depletes willpower.

- Turn off all non-essential notifications

- Use "Do Not Disturb" mode during trading

- Create a separate browser profile for trading

Component 3: Accountability

Solo trading is discipline's worst enemy. Without external accountability, it's too easy to rationalize rule-breaking.

The Trading Buddy:

Find another trader at a similar level. Share your rules with each other. Check in daily.

The format is simple:

- Morning: "Here are my rules for today."

- Evening: "Here's how I did. I followed/broke rule X."

Knowing someone will ask about your discipline changes your behavior.

Consequence Systems:

Create consequences for breaking rules that don't involve money:

- Break a rule = no trading tomorrow

- Break a rule = 50 pushups

- Break a rule = donate $20 to a cause you dislike

Component 4: Friction

Friction is the secret weapon of discipline. Make good habits frictionless. Make bad habits friction-full.

Adding Friction to Bad Habits:

- The 10-Second Rule: Before any trade, count to 10

- The Cooling-Off Period: Wait 15 minutes after a loss before trading again

- The Confirmation Requirement: Write down why before oversizing

Removing Friction from Good Habits:

- Pre-filled journal templates

- One-click access to checklists

- Default position sizes set to standard amounts

The Identity Shift

The deepest level of the Discipline Equation isn't about systems—it's about identity.

"Every action you take is a vote for the type of person you wish to become." — James Clear

There's a difference between:

- "I want to be profitable" (outcome-based)

- "I am a disciplined trader" (identity-based)

When your identity is "disciplined trader," breaking rules creates cognitive dissonance. It feels wrong because it conflicts with who you are.

Building Trading Identity

- Start with small wins: Follow one rule perfectly for a week

- Celebrate process, not outcomes: "I followed my rules" matters more than "I made money"

- Use identity language: Say "I don't revenge trade" instead of "I'm trying not to revenge trade"

Common Mistakes to Avoid

Mistake 1: Too Many Rules

Start with 3 rules maximum. Master those before adding more. Complexity kills discipline.

Solution: Identify your top 3 discipline problems. Create systems for those only.

Mistake 2: Relying on Motivation

Motivation is temporary. Systems are permanent. Don't wait until you "feel motivated."

Solution: Build systems that work regardless of how you feel.

Mistake 3: All-or-Nothing Thinking

Missing one day doesn't mean you've failed. The goal is consistency, not perfection.

Solution: When you slip, get back on track immediately. No shame spirals.

Key Takeaways

Discipline is a system, not a character trait. You don't need more willpower—you need better systems.

Willpower depletes throughout the day. Design your environment so good habits don't require willpower.

Use implementation intentions. "When X happens, I will do Y" removes in-the-moment decisions.

Environment shapes behavior. Add friction to bad habits, remove friction from good habits.

Accountability changes everything. Find a trading buddy. Share your rules. Create consequences.

Identity drives behavior. "I am a disciplined trader" is more powerful than "I want to be disciplined."

Start small, build momentum. Master 3 rules before adding more.

Frequently Asked Questions

How long does it take to build trading discipline?

Building sustainable trading discipline typically takes 2-3 months of consistent system implementation. The first 30 days focus on establishing basic habits and systems. Days 30-60 involve refining and adjusting based on what works. By day 90, most traders see significant improvement in rule compliance. However, discipline is an ongoing practice, not a destination.

Can you build discipline without an accountability partner?

Yes, but it's harder. If you can't find a trading buddy, create alternative accountability: public journaling (anonymized), consequence systems, or even AI-based check-ins. The key is external structure that creates consequences for rule-breaking. Solo accountability requires more robust systems and environment design.

What if you keep breaking the same rule despite having systems?

If you consistently break the same rule, the system isn't strong enough. Add more friction: require written justification before breaking the rule, implement a cooling-off period, or create a more significant consequence. Also examine whether the rule itself is realistic—sometimes rules need adjustment, not more enforcement.

Should you punish yourself for breaking rules?

Consequences should be uncomfortable but not punitive. The goal is behavior change, not self-flagellation. Effective consequences create pause before rule-breaking, not shame after. If your consequence system creates shame spirals, it's too severe. Adjust to something that creates accountability without emotional damage.

How do you maintain discipline during losing streaks?

Losing streaks are the ultimate discipline test. Pre-plan your response: "After X consecutive losses, I will [specific action]." Reduce position size during drawdowns—not because of math, but because emotional decision-making increases. Lean heavily on accountability during these periods. And remember: following rules during a losing streak is the highest form of discipline.

Is it possible to be too disciplined?

Yes. Over-rigid discipline can prevent adaptation and learning. The goal is disciplined flexibility: strict adherence to core rules, but openness to adjusting rules based on evidence. Review your rules quarterly. If a rule consistently doesn't serve you, change it—but change it deliberately, not impulsively.

What's the relationship between discipline and trading success?

Discipline is necessary but not sufficient for trading success. You also need a valid edge, proper risk management, and adequate capitalization. However, without discipline, even the best strategy fails. Discipline is the foundation that allows everything else to work.

Conclusion

Trading discipline isn't about being stronger, trying harder, or wanting it more.

It's about building systems that make following rules the path of least resistance.

The Discipline Equation—(Systems + Environment + Accountability) / Friction—provides a framework for sustainable discipline that doesn't depend on willpower.

Start small. Pick your top 3 discipline problems. Build systems for those. Design your environment. Find accountability. Engineer friction.

"Habits are the compound interest of self-improvement." — James Clear

Every day you follow your rules is a vote for the disciplined trader you're becoming. The compound effect of those votes, over time, transforms who you are.

You don't need more discipline. You need better systems.

Build them.

Related Articles: