Daily Trading Routine: How Routine Transformed 2025 (Manual Trading & Automation Lessons)

How a daily trading routine transformed my friend's 2025 vs 2024, plus lessons from building automated systems. Consistency wins—whether manual or automated.

Profabighi Capital Research Team

December 29, 2025

Important Notice

This content is provided for informational and educational purposes only. It should not be considered as financial, investment, or trading advice.

A friend of mine who trades manually told me that 2025 has been his best trading year ever. Not because of better analysis or a new strategy—because he finally built a daily routine and stuck to it all year.

His 2024 was chaos. He'd wake up whenever, check his phone for market news, maybe eat breakfast, maybe not. Some days he'd start trading at market open. Other days he'd miss the first hour because he was "still getting ready." His results were as inconsistent as his preparation.

Then he committed to a routine for 2025. The difference has been transformational.

Meanwhile, I took a completely different path. I don't trade manually—I build automated trading systems. My days aren't spent watching charts or reading news. They're spent writing code, running backtests, and debugging errors. Hundreds of errors. Failed strategies. Code that breaks at 3 AM.

But 2025 taught me the same lesson my friend learned: you keep going anyway. Every error teaches something. Every failed backtest narrows down what works. The code doesn't care about your feelings—it either works or it doesn't. And that brutal honesty has made 2025 my best year for system development.

Here's what both paths have taught us: consistency in execution creates consistency in results. Whether you're following a morning ritual or pushing through your hundredth code error—showing up every day is what matters.

Why His 2025 Beat 2024: Routines Matter More Than Strategy

Here's a counterintuitive truth: your daily trading routine might matter more than your trading strategy.

Looking back at my friend's 2024 vs 2025, he used the same strategies. The same setups. The same indicators. The only difference was the routine.

A mediocre strategy executed consistently will outperform a great strategy executed inconsistently.

Why? Because trading is a game of probabilities played over thousands of trades. Your edge only manifests with consistent execution. And consistent execution requires consistent preparation.

The same applies to building automated systems. A simple strategy that you actually deploy and maintain will outperform a complex strategy that never leaves your backtesting environment.

"We are what we repeatedly do. Excellence, then, is not an act, but a habit." — Aristotle

The Science of Routines

Research shows that routines reduce decision fatigue. Every decision you make depletes your mental energy. By automating your preparation through routine, you preserve mental energy for the decisions that matter: your trades.

Professional athletes don't wing their pre-game preparation. Surgeons don't improvise their pre-surgery protocols. Why would traders approach their craft any differently?

The Four Pillars of a Trading Routine

A complete daily trading routine has four components:

- Morning Ritual - Before the market opens

- Trading Session Protocol - During active trading

- Post-Market Review - After the market closes

- Weekend Analysis - Strategic weekly review

Let's break down each one.

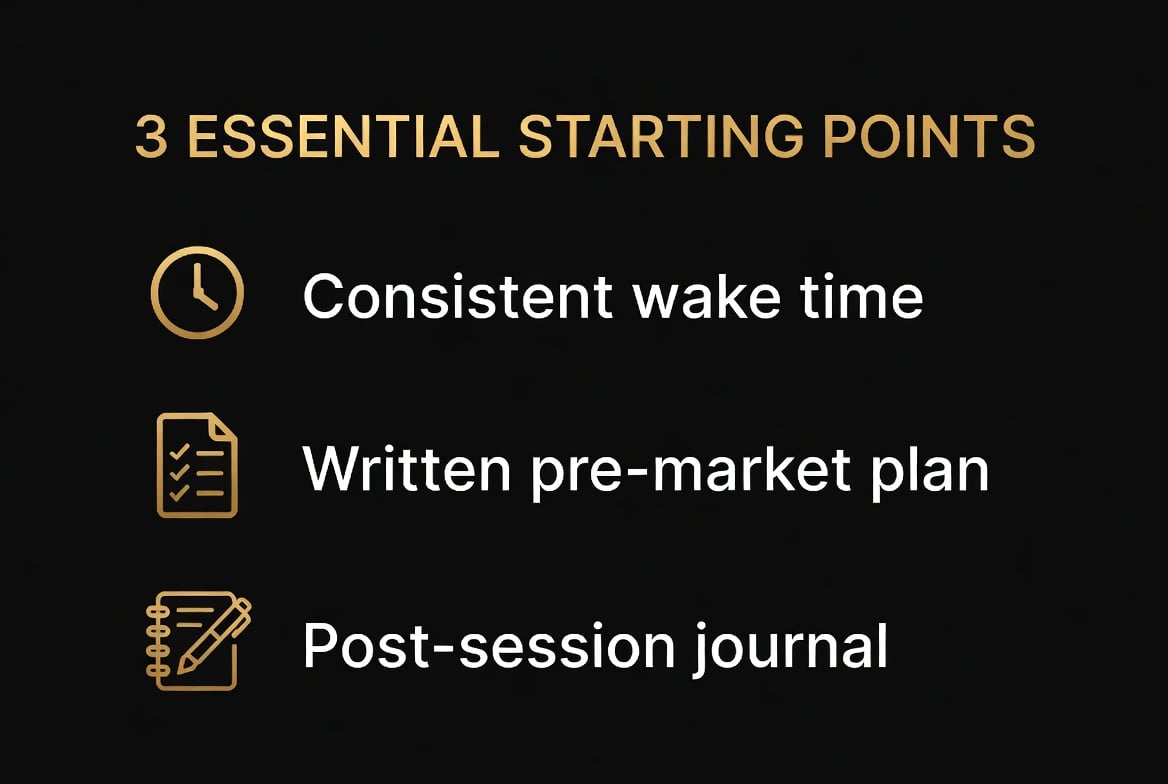

Pillar 1: The Morning Ritual

Your morning ritual sets the foundation for your entire trading day. It has three components: physical, mental, and analytical.

Physical Preparation

Sleep: This is non-negotiable. Sleep deprivation impairs decision-making as much as alcohol. Aim for 7-8 hours. If you can't get enough sleep, consider whether you should trade that day.

Exercise: Even 15-20 minutes of movement improves cognitive function and emotional regulation. This doesn't have to be intense—a walk, stretching, or light cardio works.

Nutrition: Eat something. Trading on an empty stomach leads to irritability and poor decisions. Avoid heavy meals that cause energy crashes.

Hydration: Keep water at your desk. Dehydration impairs concentration.

Mental Preparation

Meditation/Breathing: Even 5-10 minutes of meditation or deep breathing calms the nervous system and improves focus. Apps like Headspace or Calm can guide you.

Intention Setting: Write down your intention for the day. Not a P&L goal—a process goal.

Examples:

- "Today I will follow my checklist before every trade"

- "Today I will take only A+ setups"

- "Today I will stop trading after 3 losses"

Gratitude: Briefly acknowledge what you're grateful for. This shifts your mindset from scarcity to abundance, reducing desperation in your trading.

Analytical Preparation

Market Review: Check overnight developments, economic calendar, and key levels. Know what's happening before you trade.

Watchlist: Identify 3-5 instruments you'll focus on. Don't try to watch everything.

Scenario Planning: For each watchlist item, identify potential setups. "If price does X, I'll look for Y."

Sample Morning Ritual (60-90 minutes before market open)

| Time | Activity | Duration |

|---|---|---|

| Wake | Hydrate, light stretch | 10 min |

| +10 | Exercise or walk | 20 min |

| +30 | Shower, breakfast | 20 min |

| +50 | Meditation/breathing | 10 min |

| +60 | Market review, watchlist | 20 min |

| +80 | Intention setting, journal | 10 min |

Pillar 2: The Trading Session Protocol

Once the market opens, you need structure to maintain discipline.

Pre-Trade Checklist

Before every trade, run through your checklist:

- Does this match your setup criteria?

- Is your position size within your rules?

- Do you have a clear stop loss?

- Do you have a clear target?

- Are you in a good emotional state?

If any answer is "no," don't take the trade.

Real-Time Journaling

Keep a simple log during the session:

- Time of trade

- Reason for entry (one sentence)

- Emotional state (one word)

This takes 30 seconds per trade and provides invaluable data for your review.

Scheduled Breaks

Trading requires intense focus. Schedule breaks to maintain performance:

- Every 90 minutes: 5-10 minute break. Stand up, stretch, look away from screens.

- Midday: 15-30 minute break. Eat lunch away from your desk.

Circuit Breakers

Pre-define when you'll stop trading:

- After X consecutive losses

- After X% daily loss

- After X% daily gain (yes, this matters too)

- At a specific time

When a circuit breaker triggers, you're done for the day. No exceptions.

Sample Session Protocol

| Event | Action |

|---|---|

| Market open | Review watchlist, wait for setups |

| Before each trade | Run pre-trade checklist |

| After each trade | Log in real-time journal |

| Every 90 min | 5-10 min break |

| Midday | 15-30 min lunch break |

| Circuit breaker hit | Stop trading, begin review |

Pillar 3: Post-Market Review

The post-market review is where learning happens. Most traders skip this—which is why most traders don't improve.

Trade Review

For each trade taken:

- Did you follow your rules?

- What was your emotional state?

- What would you do differently?

- What did you do well?

Daily Statistics

Track basic metrics:

- Number of trades

- Win rate

- Average win vs. average loss

- Rule compliance percentage

Emotional Assessment

Rate your overall emotional state for the day (1-10). Note any triggers or patterns.

Tomorrow's Preparation

- Any overnight positions to manage?

- Key levels for tomorrow?

- Economic events to watch?

Sample Post-Market Review (20-30 minutes)

| Activity | Duration |

|---|---|

| Trade review | 10 min |

| Statistics update | 5 min |

| Emotional assessment | 5 min |

| Tomorrow prep | 5 min |

Pillar 4: Weekend Analysis

The weekend is for strategic thinking that daily trading doesn't allow.

Weekly Performance Review

- Total P&L for the week

- Win rate and expectancy

- Best and worst trades

- Rule compliance percentage

Pattern Recognition

Look for patterns across the week:

- Which days performed best/worst?

- Which setups worked/didn't work?

- Any emotional patterns?

Strategy Adjustment

Based on your review:

- Any rules to add or modify?

- Any setups to focus on or avoid?

- Any habits to change?

Next Week Preparation

- Key economic events

- Major levels on watchlist instruments

- Focus areas for improvement

Sample Weekend Analysis (1-2 hours)

| Activity | Duration |

|---|---|

| Weekly statistics | 15 min |

| Trade-by-trade review | 30 min |

| Pattern analysis | 20 min |

| Strategy notes | 15 min |

| Next week prep | 15 min |

Building the Routine: How My Friend Did It in 2025

The biggest mistake traders make with routines is trying to implement everything at once. That's what he did wrong in 2024.

In 2025, he took a different approach:

January-February: Morning Only

Started with just the morning ritual. Mastered that before adding more.

March-April: Add Session Protocol

Once his morning was automatic, he added the pre-trade checklist and real-time journaling.

May-June: Add Post-Market Review

Then he added the end-of-day review.

July onwards: Add Weekend Analysis

Finally, he implemented the weekend strategic review.

By the second half of 2025, everything was automatic. The compound effect over the year has been incredible.

"Habits are the compound interest of self-improvement." — James Clear

Common Mistakes to Avoid

Mistake 1: Too Complex

A routine you can't maintain is worthless. Start simple. Add complexity only after basics are automatic.

Mistake 2: Skipping When Busy

The days you "don't have time" for your routine are often the days you need it most. A shortened routine is better than no routine.

Mistake 3: No Flexibility

Life happens. Your routine should have a "minimum viable" version for difficult days. What's the absolute minimum you need to do?

Mistake 4: Outcome Focus

Your routine should focus on process, not outcomes. "I will follow my checklist" not "I will make $500."

Key Takeaways

Consistency in preparation creates consistency in results. Your routine might matter more than your strategy.

Four pillars: Morning ritual, session protocol, post-market review, weekend analysis.

Start small. Master one component before adding the next.

Physical preparation matters. Sleep, exercise, nutrition, and hydration affect your trading.

Pre-trade checklists prevent emotional trades. Use them for every entry.

Post-market review is where learning happens. Don't skip it.

Weekend analysis provides strategic perspective. Daily trading misses the big picture.

Frequently Asked Questions

How long should your morning routine be?

Start with 30 minutes and expand as needed. Most successful traders spend 60-90 minutes on morning preparation. The key is consistency—a 30-minute routine you do every day beats a 2-hour routine you skip half the time.

What if you trade multiple sessions or markets?

Adapt the framework to your schedule. If you trade Asian, European, and US sessions, you might have a shorter routine before each session rather than one long morning routine. The principles remain the same.

Should you trade if you can't complete your routine?

This depends on your minimum viable routine. Define the absolute essentials—maybe it's 10 minutes of market review and setting your intention. If you can't do even that, consider whether trading that day is wise.

How do you maintain your routine when traveling?

Create a travel version of your routine. Identify what you can do anywhere (meditation, intention setting, basic market review on phone) and what requires your full setup. Accept that travel days might mean reduced trading or no trading.

What if your routine isn't working?

Give it at least 30 days before judging. If it's still not working, examine what specifically isn't working. Is it too complex? Wrong timing? Missing a key element? Adjust one thing at a time.

Do professional traders really follow routines this strictly?

Yes. The most consistent traders are almost religious about their routines. They understand that the market provides enough chaos—their preparation doesn't need to add more.

How do you handle days when you don't feel like following your routine?

Those are exactly the days when routine matters most. Your routine is designed to work when motivation doesn't. If you consistently don't feel like following your routine, examine whether it's too complex or whether there's a deeper issue with your trading.

Conclusion

My friend's 2025 has been his best trading year ever—not because of better analysis, but because of routine. And my 2025 has been my best year for system development—not because I'm smarter, but because I kept coding through every error.

A daily trading routine isn't about rigidity—it's about creating the conditions for consistent performance. Looking back at his 2024 vs 2025, the difference is clear: same strategies, same setups, completely different results.

The market is unpredictable. Your preparation doesn't have to be.

Start with one component. Master it. Add the next. Over time, your routine becomes automatic, freeing your mental energy for what matters: making good trading decisions.

"The secret of your success is found in your daily routine." — John C. Maxwell

Build your routine. Follow it consistently. Watch your trading year transform.

Related Articles

- The Stoic Trader Framework: Ancient Philosophy for Modern Markets - Apply Stoic principles to build emotional resilience and trading discipline

- Fear & Greed Mastery - Master the emotional forces that drive trading decisions

- Christmas Gratitude: A Trading Reflection - Reflection on trading psychology and gratitude practices