The Stoic Trader Framework: Ancient Philosophy for Modern Markets

Master trading psychology with Stoic philosophy. Learn the Dichotomy of Control, Amor Fati, and practical frameworks from Marcus Aurelius and Epictetus for better trading.

Profabighi Capital Research Team

December 21, 2025

Important Notice

Please review this content carefully and use your own judgment when applying any information provided.

Two thousand years ago, a Roman Emperor wrote a private journal that would become one of the most influential books on human psychology ever written. Marcus Aurelius never intended for his "Meditations" to be published. He wrote them for himself - reminders on how to think clearly, act wisely, and maintain equanimity in the face of chaos.

Today, those same principles offer traders something no indicator or strategy can provide: a framework for psychological mastery.

This guide explores how Stoic philosophy - developed by Marcus Aurelius, Epictetus, and Seneca - can transform your trading psychology.

What Is Stoicism?

Stoicism is a school of philosophy founded in Athens around 300 BCE. Its core teaching is simple but profound: some things are within your control, and some things are not. Wisdom lies in knowing the difference and focusing only on what you can control.

The Stoics weren't emotionless robots. They experienced fear, desire, and frustration like everyone else. But they developed practices to prevent these emotions from controlling their actions.

For traders, this distinction is everything.

The Four Pillars of Stoic Trading

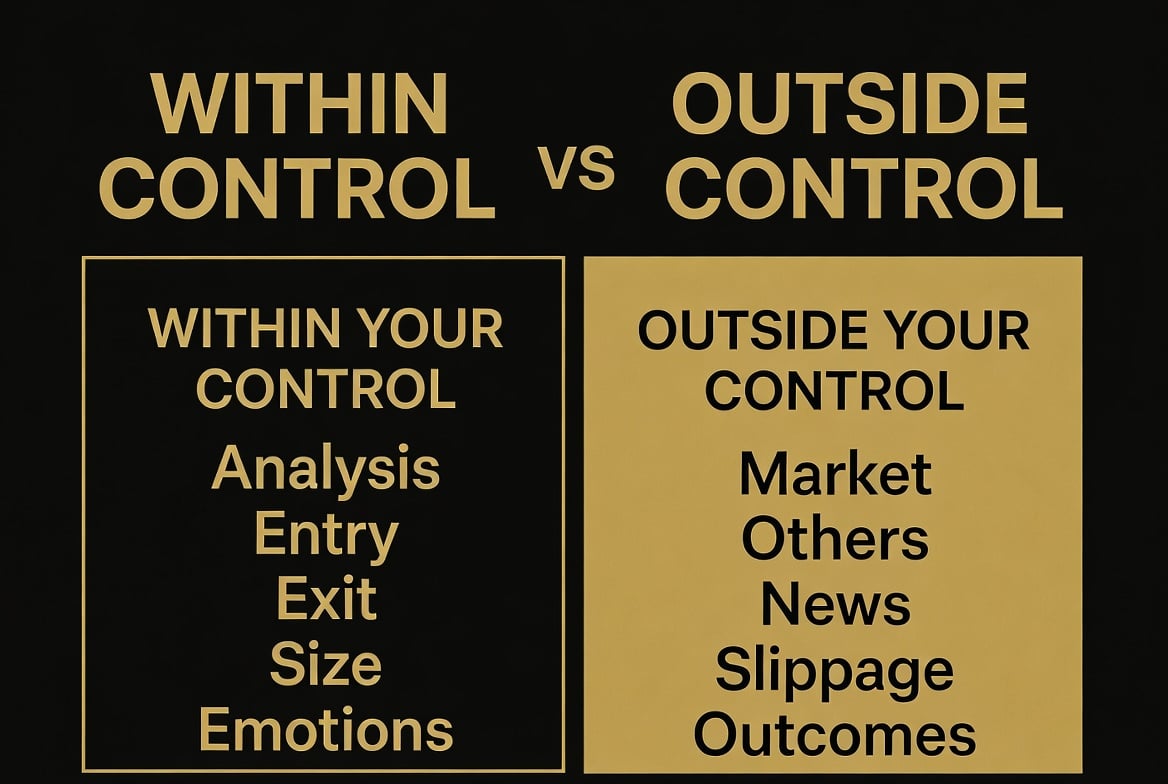

Pillar 1: The Dichotomy of Control

The foundation of Stoic philosophy is the Dichotomy of Control, articulated most clearly by Epictetus:

"Make the best use of what is in your power, and take the rest as it happens." - Epictetus

In trading, this translates to a clear separation:

What You CAN Control:

- Your analysis and research

- Your entry criteria

- Your exit rules

- Your position sizing

- Your emotional state

- Your process and discipline

What You CANNOT Control:

- Market direction

- Other traders' actions

- News events and announcements

- Slippage and execution

- Whether any individual trade wins or loses

Most traders spend enormous mental energy on things they cannot control. They worry about market direction, stress about news events, and obsess over whether their current trade will win.

The Stoic trader redirects that energy entirely. Before every trade, ask: "Am I focused on what I can control?"

"You have power over your mind - not outside events. Realize this, and you will find strength." - Marcus Aurelius

Pillar 2: Amor Fati (Love Your Fate)

Amor Fati means "love of fate" - the practice of accepting and even embracing everything that happens.

For traders, this means:

- Every loss is a lesson. Not a failure, not a punishment - data for improvement.

- Every win is a bonus. Not an expectation, not a right - a gift from following your process.

- Every trade is information. Neither good nor bad - just feedback.

The shift is from "Why did this happen to me?" to "What can I learn from this?"

This doesn't mean being passive or not caring about results. It means accepting outcomes without letting them disturb your equanimity. You can be disappointed by a loss while still accepting it as part of the process.

Pillar 3: Memento Mori (Remember Death)

Memento Mori - "remember that you will die" - sounds morbid, but its purpose is perspective.

For traders, the application is:

- This trade is not your last. You will have thousands more opportunities.

- This loss is not the end. It's one data point in a lifetime of trading.

- This drawdown is temporary. All drawdowns end, one way or another.

When you're in the middle of a losing streak, it feels permanent. Memento Mori reminds you to zoom out.

Ask yourself: "Will this trade matter in 5 years?"

The answer is almost always no. But your habits, your discipline, your process - those compound over 5 years. Focus on what compounds.

Pillar 4: Premeditatio Malorum (Negative Visualization)

Premeditatio Malorum is the practice of visualizing negative outcomes before they happen - not to be pessimistic, but to be prepared.

Before every trade, the Stoic trader asks:

- "What if this trade loses?"

- "What if I hit my maximum daily loss?"

- "What if this drawdown continues?"

By mentally rehearsing these scenarios, you:

- Reduce emotional shock when they occur

- Make better decisions because you've already thought through responses

- Size positions appropriately because you've accepted the worst case

Seneca wrote:

"We suffer more often in imagination than in reality."

Paradoxically, by imagining the worst, you suffer less when it happens - because you've already processed it.

The Stoic Pre-Trade Protocol

Before every trade, run through this Stoic-inspired checklist:

1. Control Check

- Am I focused on what I can control (my process)?

- Or am I focused on what I can't control (the outcome)?

2. Acceptance Check

- Have I accepted that this trade might lose?

- Is my position size appropriate for the worst case?

3. Process Check

- Am I trading my system, or trading my emotions?

- Would I take this trade if I knew it would lose?

4. Perspective Check

- Will this trade matter in 5 years?

- Am I treating this as one trade among thousands?

If you can answer "yes" to all these questions, proceed. If not, step back and recalibrate.

Stoic Wisdom for Common Trading Challenges

Challenge: Revenge Trading After a Loss

Stoic Response: The loss already happened. It's in the past - outside your control. The only thing in your control now is your next action. Will you compound the damage with an emotional trade? Or will you accept the loss and return to your process?

"It's not what happens to you, but how you react to it that matters." - Epictetus

For practical techniques to manage revenge trading, see our Fear and Greed Trading Psychology Guide.

Challenge: FOMO When Missing a Move

Stoic Response: You cannot control market movements. You can only control your entries based on your criteria. If the move didn't meet your criteria, you made the right decision - regardless of what happened after.

Learn more about managing FOMO in our Fear and Greed in Trading guide.

Challenge: Anxiety About Open Positions

Stoic Response: Once you've entered a trade with proper risk management, the outcome is outside your control. Your job is done. Worrying changes nothing except your mental state.

"We suffer more often in imagination than in reality." - Seneca

Challenge: Overconfidence After a Winning Streak

Stoic Response: Winning streaks end. This is not pessimism - it's reality. The Stoic remains equanimous in both winning and losing streaks, knowing both are temporary.

The Paradox of Detachment

Here's the counterintuitive truth: when you stop caring about outcomes, your outcomes improve.

Why? Because outcome-detachment eliminates:

- Revenge trading (trying to recover losses)

- Oversizing (betting big on "sure things")

- Moving stops (hoping for recovery)

- Chasing (entering late out of FOMO)

- Panicking (exiting early out of fear)

When you're detached from outcomes, you simply trade your system. And systems, executed consistently, produce results.

This doesn't mean you don't want to make money. It means you understand that wanting doesn't influence outcomes - only process does.

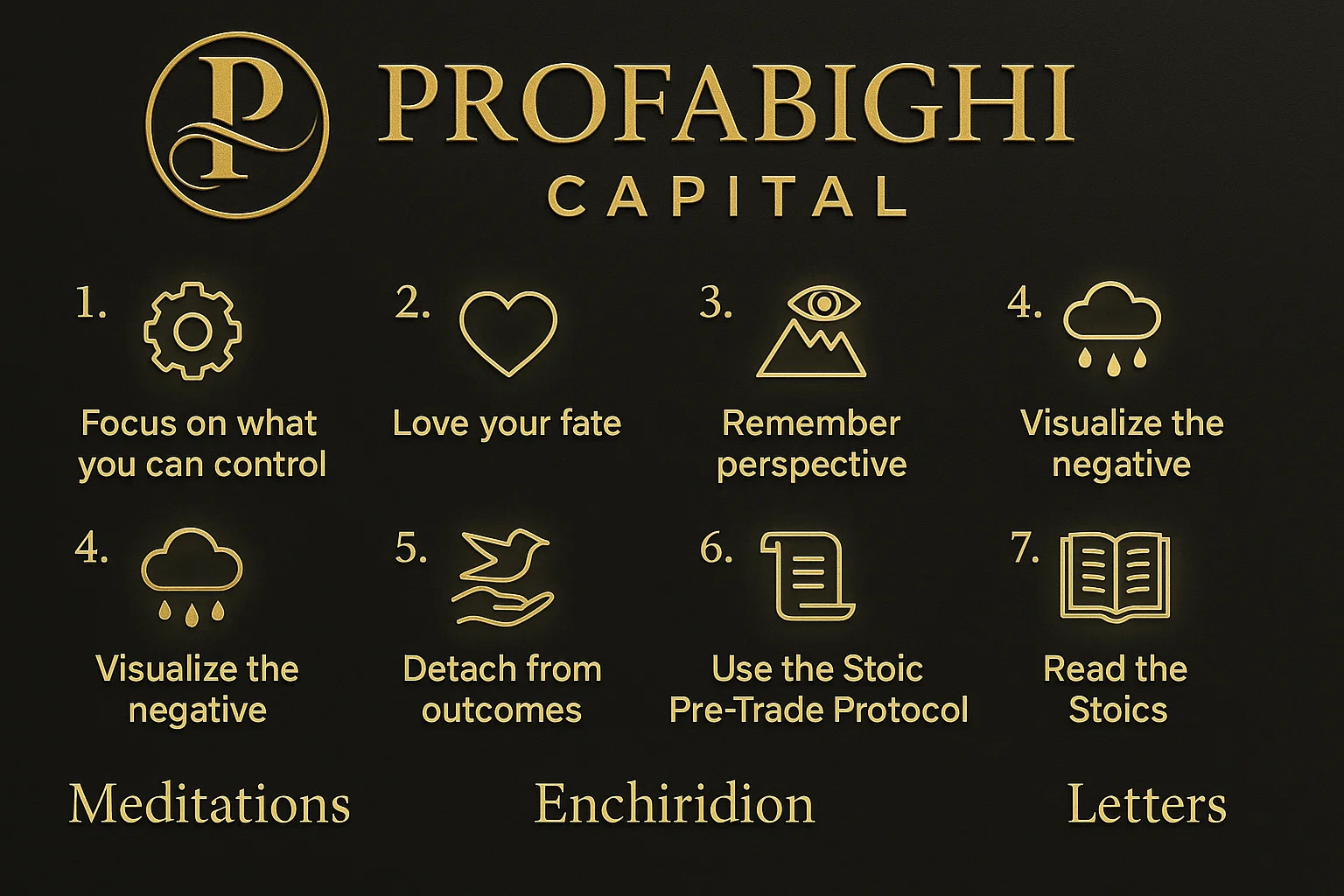

Key Takeaways

Focus on what you can control. Your analysis, entries, exits, position size, and emotions. Let go of everything else.

Love your fate. Every loss is a lesson. Every win is a bonus. Every trade is data.

Remember perspective. This trade won't matter in 5 years. Your habits will.

Visualize the negative. Accept the worst case before entering. You'll trade better when nothing can surprise you.

Detach from outcomes. Paradoxically, caring less about results improves results.

Use the Stoic Pre-Trade Protocol. Control check, acceptance check, process check, perspective check.

Read the Stoics. Marcus Aurelius's "Meditations," Epictetus's "Enchiridion," and Seneca's "Letters" offer timeless wisdom.

Frequently Asked Questions

Is Stoicism about suppressing emotions?

No. Stoicism is about not being controlled by emotions. Stoics experience fear, desire, and frustration like everyone else. The difference is they don't let these emotions dictate their actions. You can feel disappointed by a loss while still accepting it and moving forward rationally.

How long does it take to develop a Stoic trading mindset?

Like any skill, it develops gradually with practice. Most traders notice improvement within 2-3 months of consistent application. However, Stoicism is a lifelong practice, not a destination. Even Marcus Aurelius, after decades of practice, still wrote reminders to himself.

Can Stoicism work alongside technical analysis?

Absolutely. Stoicism addresses the psychological side of trading, not the analytical side. You can use any technical or fundamental approach while applying Stoic principles to your psychology. In fact, Stoicism helps you execute your analysis more consistently by removing emotional interference.

What's the best Stoic text for traders?

Start with Marcus Aurelius's "Meditations." It's short, practical, and directly applicable to trading psychology. Epictetus's "Enchiridion" is also excellent for its focus on the Dichotomy of Control. Both are available free online.

How do you practice Stoicism daily?

Start with a morning reflection: remind yourself what you can and cannot control today. Before each trade, run through the Stoic Pre-Trade Protocol. In the evening, review: did you focus on process or outcomes? Did you accept what happened? Over time, these practices become automatic.

Does Stoicism mean you shouldn't have trading goals?

No. Stoics had goals - Marcus Aurelius ruled an empire. The key is focusing on process goals (what you control) rather than outcome goals (what you don't). "I will follow my system" is a Stoic goal. "I will make $1,000 today" is not.

What if Stoic detachment makes me not care about trading?

True Stoic detachment isn't apathy - it's equanimity. You still care about trading well. You still want to improve. You just don't let individual outcomes disturb your peace. The Stoics were some of the most accomplished people in history. Detachment from outcomes didn't make them passive - it made them effective.

Conclusion

The Stoics didn't have charts, indicators, or trading platforms. But they understood something that most modern traders never learn: the battle isn't with the market. The battle is with yourself.

Win that battle first.

Focus on what you can control. Accept what you cannot. Embrace every outcome as an opportunity to learn. Maintain perspective across thousands of trades.

"The happiness of your life depends upon the quality of your thoughts." - Marcus Aurelius

Your trading results depend on the quality of your process. Control your thoughts. Control your process. The results follow.

Related Reading

- Fear and Greed in Trading: Complete Psychology Guide - Master emotional trading with the STOP technique

- Christmas Trading Reflection: Why Gratitude Beats FOMO - Learn the power of reflection and gratitude

- Portfolio Efficiency Optimizer - Combine risk metrics for better decisions