Fear and Greed in Trading: The Complete Psychology Guide to Mastering Your Emotions

Master trading psychology with our comprehensive fear and greed guide. Learn the STOP technique, recognize emotional triggers, and build pre-commitment strategies.

Profabighi Capital Research Team

December 27, 2025

Important Notice

This content is provided for informational and educational purposes only. It should not be considered as financial, investment, or trading advice.

"Be fearful when others are greedy and greedy when others are fearful." — Warren Buffett

Picture this scenario: Bitcoin is pumping. Everyone on Twitter is posting gains. Green candles everywhere. You've been waiting for a pullback. Your analysis says wait. Your system says wait. Everything says wait.

But the price keeps going up. And up. And up.

"What if this is the bottom?" you think. "What if I miss the entire move?"

You buy at the top. Full size. No stop loss because "it's going higher."

Three days later, you're down 20%.

That trade wasn't bad analysis. It was pure FOMO—Fear Of Missing Out. And it's one of the most expensive lessons in trading: emotions don't care about your analysis.

This guide will teach you how to recognize and manage the two most powerful forces in trading: fear and greed.

The Two Forces That Control Every Trader

Every trading decision you make is influenced by two primal forces: fear and greed.

These aren't character flaws. They're evolutionary survival mechanisms. Fear kept our ancestors alive by making them avoid danger. Greed drove them to accumulate resources for survival.

The problem? Financial markets didn't exist when these instincts evolved. Your brain treats a losing trade like a saber-toothed tiger attack. It treats a winning streak like finding a rare food source that must be exploited immediately.

Buffett's famous quote sounds simple. In practice, it's nearly impossible—because when others are greedy, your brain screams "join them!" And when others are fearful, your brain screams "run!"

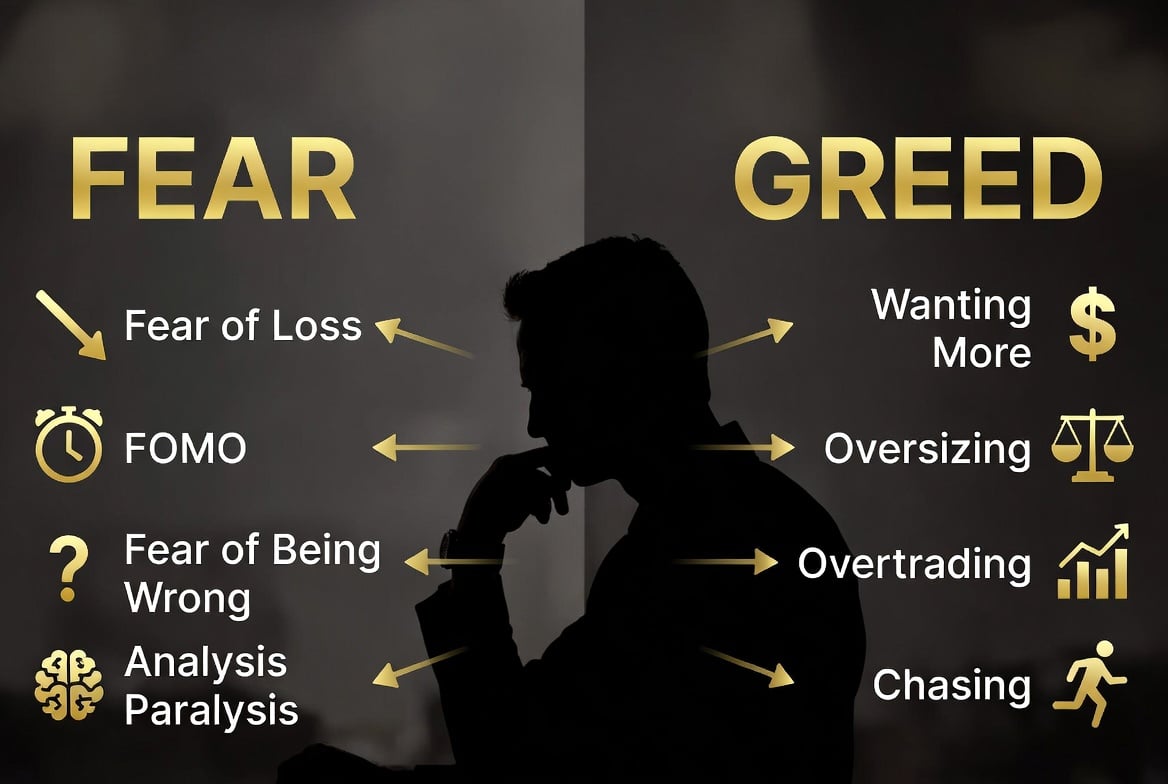

Understanding Fear in Trading

Fear in trading isn't one emotion—it's a family of related fears, each with different triggers and consequences.

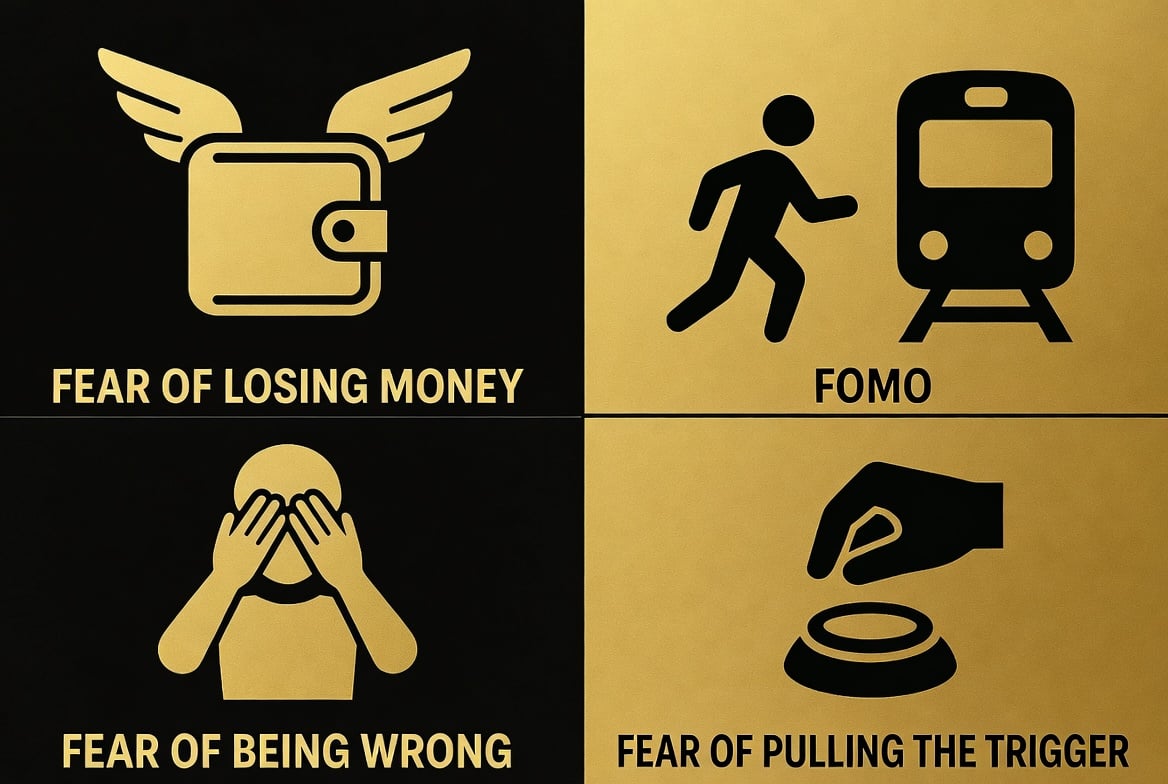

Fear Type 1: Fear of Losing Money

This is the most obvious fear. It manifests as:

- Cutting winners too early ("lock in the profit before it disappears")

- Not taking valid setups ("what if I'm wrong?")

- Using stops that are too tight (getting stopped out before the move)

Fear Type 2: Fear of Missing Out (FOMO)

FOMO is fear disguised as opportunity. It manifests as:

- Chasing price after it's already moved

- Entering without your usual criteria

- Oversizing because "this is the one"

- Abandoning your system for "obvious" trades

Fear Type 3: Fear of Being Wrong

This fear attacks your ego, not your wallet. It manifests as:

- Not cutting losses (admitting you were wrong)

- Averaging down on losers (proving you were right)

- Ignoring contradictory evidence

- Confirmation bias in analysis

Fear Type 4: Fear of Pulling the Trigger

Analysis paralysis. You see the setup, it matches your criteria, but you can't click the button. It manifests as:

- Waiting for "one more confirmation"

- Missing trades you identified correctly

- Overanalyzing until the opportunity passes

Understanding Greed in Trading

Greed is fear's partner in destruction. Where fear makes you act too cautiously, greed makes you act too aggressively.

Greed Type 1: Wanting More

You hit your target. Your system says exit. But the trade is still moving in your favor. "Just a little more..."

This manifests as:

- Moving targets further away

- Removing stops on winning trades

- Turning day trades into swing trades

- Watching profits evaporate

Greed Type 2: Oversizing

"This setup is perfect. I should size up."

This manifests as:

- Breaking position sizing rules

- "Just this once" exceptions

- Betting the account on "sure things"

- Catastrophic losses from single trades

Greed Type 3: Overtrading

More trades = more money, right? Wrong.

This manifests as:

- Trading when there's no setup

- Forcing trades to "stay active"

- Revenge trading after losses

- Boredom trading

Greed Type 4: Chasing

The price moved without you. Now you're running after it.

This manifests as:

- Buying after extended moves

- Entering at worse prices than planned

- FOMO entries (greed disguised as fear)

- Buying tops, selling bottoms

The Recognition Framework

You can't manage what you can't recognize. The first step in mastering fear and greed is learning to identify them in real-time.

Body Scan Technique

Fear and greed have physical signatures. Before any trade, do a quick body scan:

Signs of Fear:

- Tight chest or shallow breathing

- Tension in shoulders or jaw

- Hesitation, frozen feeling

- Urge to look away from the screen

Signs of Greed:

- Elevated heart rate, excitement

- Leaning forward toward the screen

- Rapid thoughts, racing mind

- Urge to act immediately

Thought Pattern Recognition

Listen to your internal dialogue:

Fear Thoughts:

- "What if I'm wrong?"

- "I should wait for more confirmation"

- "This could go against me"

- "I can't afford to lose this"

Greed Thoughts:

- "This is the one"

- "I should size up on this"

- "It's going to keep going"

- "I can't miss this move"

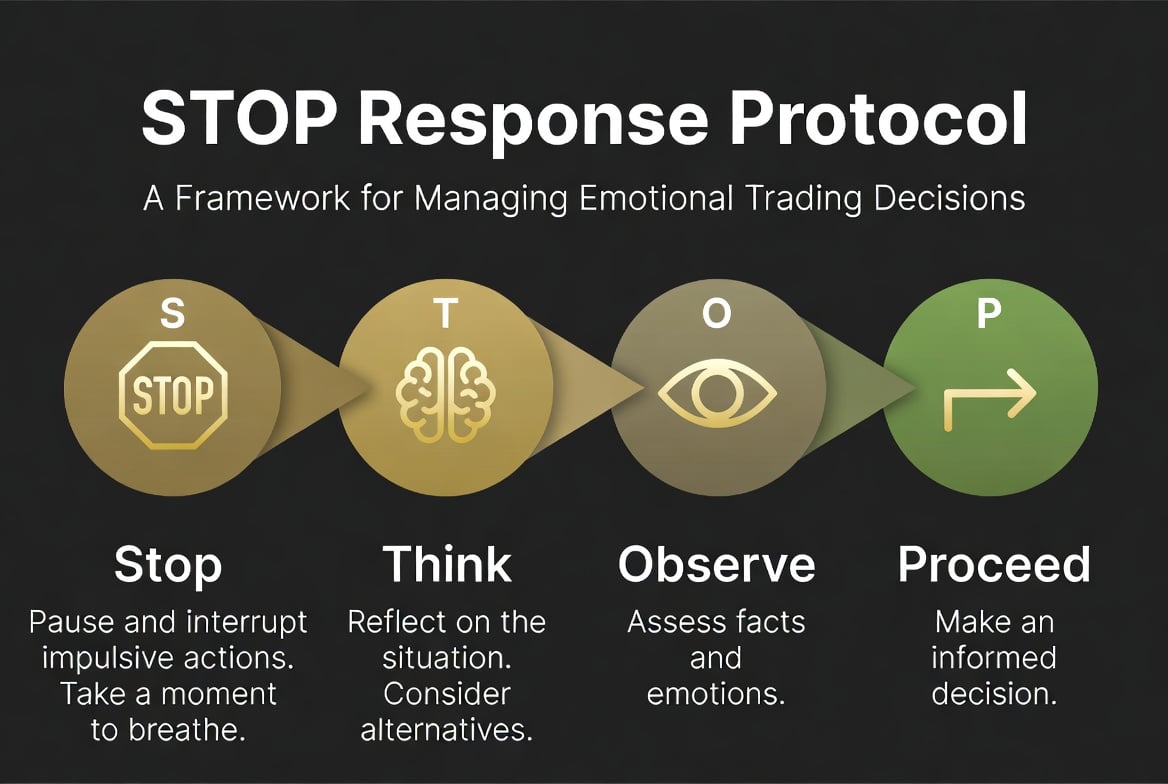

The STOP Response Protocol

When you recognize fear or greed, use the STOP technique:

S - Stop

Physically stop what you're doing. Remove your hand from the mouse. Stand up if necessary. Create physical distance from the decision.

T - Think

Ask yourself: "What am I feeling right now?" Name the emotion. Is it fear? Which type? Is it greed? Which type?

"Between stimulus and response there is a space. In that space is our power to choose our response." — Viktor Frankl

O - Observe

Look at the situation objectively:

- What does your system say?

- Does this match your criteria?

- What would you tell a friend in this situation?

- Are you following your plan or deviating?

P - Proceed

Make a conscious decision:

- If the trade matches your system: proceed

- If it doesn't: walk away

- If you're unsure: walk away

The key is that "Proceed" is a deliberate choice, not an emotional reaction.

Pre-Commitment Strategies

The best time to make trading decisions is when you're calm—not in the heat of the moment.

If-Then Rules

Create specific rules for emotional situations:

- "If I feel FOMO, I will wait 10 minutes before any action"

- "If I have 3 consecutive losses, I will stop trading for the day"

- "If I want to move my stop, I will close the trade instead"

- "If I want to size up, I will size down"

Circuit Breakers

Personal trading stops that trigger automatically:

- Daily loss limit: Stop trading after X% loss

- Win limit: Stop trading after X% gain (greed protection)

- Trade limit: Maximum X trades per day

- Time limit: No trading after X PM

Key Takeaways

Fear and greed are biological, not character flaws. Every trader experiences them.

There are multiple types of each. FOMO is different from fear of loss. Wanting more is different from oversizing.

Recognition comes before management. Learn your physical, mental, and behavioral patterns.

Use the STOP technique. Stop, Think, Observe, Proceed. Create space between stimulus and response.

Pre-commit your decisions. The best trading decisions are made when you're calm, not emotional.

Circuit breakers save accounts. Daily limits, trade limits, time limits.

FOMO is the most expensive emotion. The best trade is often the one you don't take.

Frequently Asked Questions

How do you know if you're trading from fear or greed?

Do a body scan before trading. Fear typically manifests as tension, shallow breathing, and hesitation. Greed manifests as excitement, elevated heart rate, and urgency to act. Also listen to your thoughts: fear says "what if I'm wrong?" while greed says "this is the one."

Can you eliminate fear and greed from your trading?

No, and that's not the goal. Fear and greed are biological—they're hardwired into your brain. The goal is recognition and management, not elimination. Learn to identify these emotions before they influence your decisions, then use techniques like STOP to create space for rational choice.

What's the difference between FOMO and greed?

FOMO (Fear Of Missing Out) is actually a type of fear disguised as opportunity. It's the fear that you'll miss a profitable move. Greed is the desire for more—holding winners past your target, oversizing positions, or overtrading. FOMO makes you chase; greed makes you hold too long.

How long does it take to master emotional trading?

Emotional awareness is a continuous practice, not a destination. Most traders see improvement within 2-3 months of consistent application of techniques like STOP and pre-commitment rules. However, even experienced traders must remain vigilant—emotional patterns can resurface during stressful market conditions.

What should you do immediately after an emotional trade?

First, don't beat yourself up—shame leads to more emotional trading. Second, document the trade in your journal: what emotion drove it, what triggered that emotion, and what you could do differently. Third, consider taking a break before your next trade. Use the experience as data for improvement.

Are pre-commitment rules really effective?

Yes, research consistently shows that decisions made in advance (when calm) are more rational than decisions made in the moment (when emotional). The key is making rules specific and following them without exception. "I will wait 10 minutes if I feel FOMO" is more effective than "I'll try to be less emotional."

How do circuit breakers help with emotional trading?

Circuit breakers remove the decision from the emotional moment. When you hit your daily loss limit, you don't have to decide whether to keep trading—the rule decides for you. This prevents the common pattern of emotional trading leading to more losses, leading to more emotional trading.

Conclusion

Fear and greed will always be part of trading. They're not bugs in your psychology—they're features that evolved for survival.

The traders who succeed aren't the ones who eliminate these emotions. They're the ones who recognize them faster and have systems in place to manage them.

The STOP technique, pre-commitment rules, and circuit breakers aren't about becoming emotionless. They're about creating space between what you feel and what you do.

The emotion will still be there. But the impulsive trade won't.

For deeper philosophical foundations, explore our Stoic Trader Framework.

Related Reading

- The Stoic Trader Framework: Ancient Philosophy for Modern Markets - Ancient wisdom for trading discipline

- Christmas Trading Reflection: Why Gratitude Beats FOMO - The power of reflection

- Portfolio Efficiency Optimizer - Systematic risk management