Trading Decision Making Under Pressure: Why Your Brain Sabotages Your Best Trades

Master trading decision making with cognitive bias awareness. Learn System 1 vs System 2 thinking, common trading biases, and frameworks for better decisions under pressure.

Profabighi Capital Research Team

December 30, 2025

Important Notice

This content is provided for informational and educational purposes only. It should not be considered as financial, investment, or trading advice.

Your brain is not designed for trading.

The same instincts that kept your ancestors alive on the African savanna—quick reactions, pattern recognition, fear of loss—are exactly what destroy trading accounts in modern markets.

This guide explores why you make poor decisions under pressure and provides practical frameworks for making better trading decisions when it matters most.

The Two Systems in Your Brain

In 2011, Nobel Prize-winning psychologist Daniel Kahneman published "Thinking, Fast and Slow," revolutionizing our understanding of human decision-making.

Kahneman identified two cognitive systems:

System 1: Fast Thinking

- Automatic and effortless

- Emotional and intuitive

- Pattern-matching based on past experience

- Always running in the background

- Responsible for snap judgments

System 2: Slow Thinking

- Deliberate and effortful

- Rational and analytical

- Logical reasoning and calculation

- Requires conscious attention

- Responsible for complex analysis

When you're calm, System 2 handles your trading analysis. You examine charts, calculate risk/reward ratios, verify your criteria. The process is rational and methodical.

But when pressure mounts—when you're in a losing trade, when markets are crashing, when fear or greed kicks in—System 1 takes over.

And System 1 doesn't care about your analysis. It cares about survival.

"Nothing in life is as important as you think it is, while you are thinking about it." — Daniel Kahneman

This explains why you can plan perfectly when markets are closed but make terrible decisions when you're actually in a trade that's moving against you.

The Six Biases That Destroy Traders

System 1 doesn't just take over—it brings cognitive biases with it. These mental shortcuts helped our ancestors survive. They help traders lose money.

Bias 1: Confirmation Bias

Definition: Seeking information that confirms existing beliefs while ignoring contradictory evidence.

In Trading: You're long on a position. You read every bullish article. You dismiss bearish analysis as "FUD" or "noise." You see what you want to see.

The Danger: You miss warning signs. You hold losing positions too long. You add to losers because you're "sure" you're right.

Counter-Strategy: Before any trade, actively seek the opposing view. Ask: "What would make this trade fail?"

Bias 2: Anchoring

Definition: Over-relying on the first piece of information received.

In Trading: You bought at 100 dollars. The price drops to 80 dollars. You keep thinking about 100 dollars—your "anchor." You can't accept the new reality.

The Danger: You hold waiting for your anchor price to return. You miss new opportunities because they don't match your anchor.

Counter-Strategy: Focus on current price action and future potential, not past prices. Ask: "Would I buy at this price today?"

Bias 3: Recency Bias

Definition: Giving disproportionate weight to recent events.

In Trading: Three winning trades make you feel invincible. Three losing trades make you feel cursed. Recent results dominate your thinking.

The Danger: Recent results don't predict future results. But your brain treats them like they do, leading to oversizing after wins and paralysis after losses.

Counter-Strategy: Track long-term statistics. Make decisions based on hundreds of trades, not the last three.

Bias 4: Sunk Cost Fallacy

Definition: Continuing an action because of past investment, not future potential.

In Trading: "I've already lost 5,000 dollars on this trade. I can't sell now." So you hold. And lose 10,000 dollars.

The Danger: Past losses are gone. They shouldn't influence future decisions. But emotionally, they do.

Counter-Strategy: Ask: "If I had no position, would I enter this trade today?" If no, exit.

Bias 5: Overconfidence

Definition: Overestimating your own abilities and knowledge.

In Trading: After a winning streak, you feel you "know" what the market will do. You size up. You ignore your stop loss. You break your rules.

The Danger: The market doesn't care about your confidence. Overconfidence leads to oversizing, ignoring risk management, and catastrophic losses.

Counter-Strategy: Assume you're wrong. Size positions as if every trade could lose. Follow rules regardless of confidence level.

Bias 6: Hindsight Bias

Definition: Believing, after an event, that you "knew it all along."

In Trading: "I knew the market would crash. I saw it coming." But you didn't act on it. You just remember it that way.

The Danger: You don't learn from mistakes because you convince yourself you "knew" what would happen. This prevents genuine improvement.

Counter-Strategy: Keep a decision journal. Record your actual predictions before events, not your memories after.

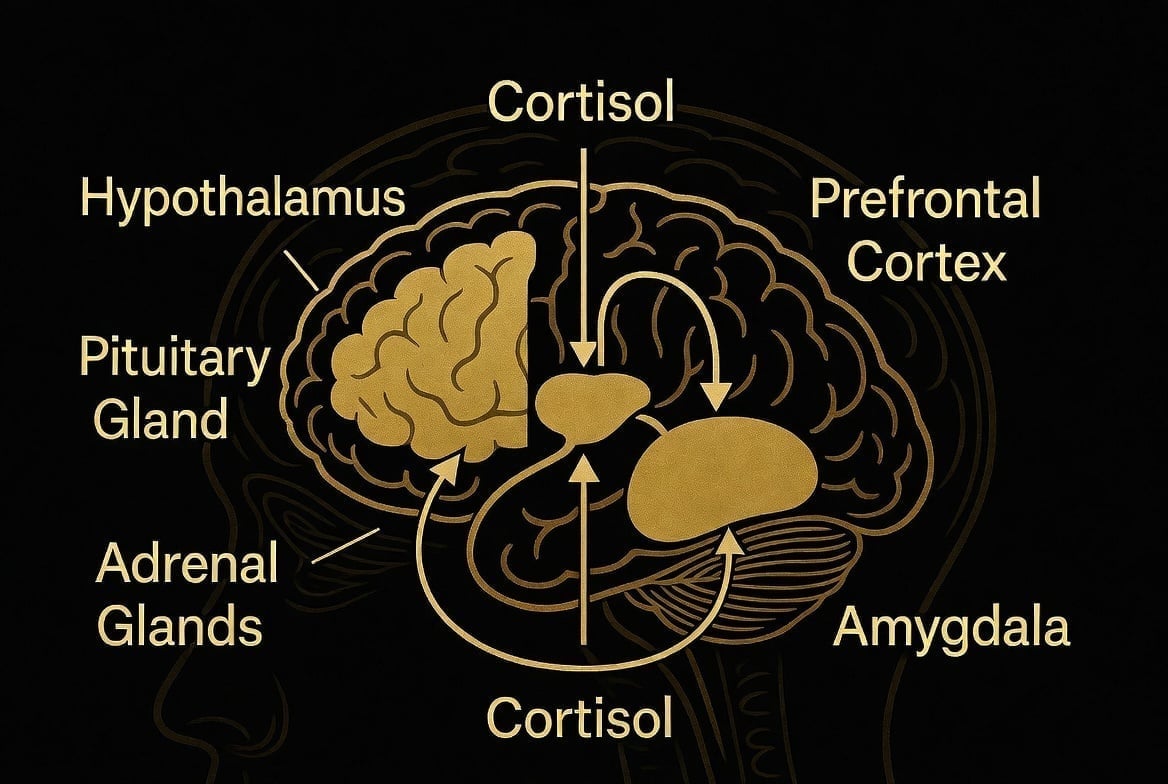

What Stress Does to Your Brain

Understanding biases is important. Understanding why they intensify under stress is crucial.

When you're stressed, your body releases cortisol, triggering the fight-flight-freeze response. Your brain literally changes:

Tunnel Vision: You focus on the immediate threat (the losing trade) and miss the bigger picture.

Impaired Reasoning: The prefrontal cortex—responsible for rational thinking—gets suppressed.

Emotional Amplification: Fear and greed become louder. Rational analysis becomes quieter.

Time Pressure: Everything feels urgent. You need to act NOW. (You usually don't.)

This is why the same trader who analyzes calmly on weekends makes panic decisions on volatile Mondays.

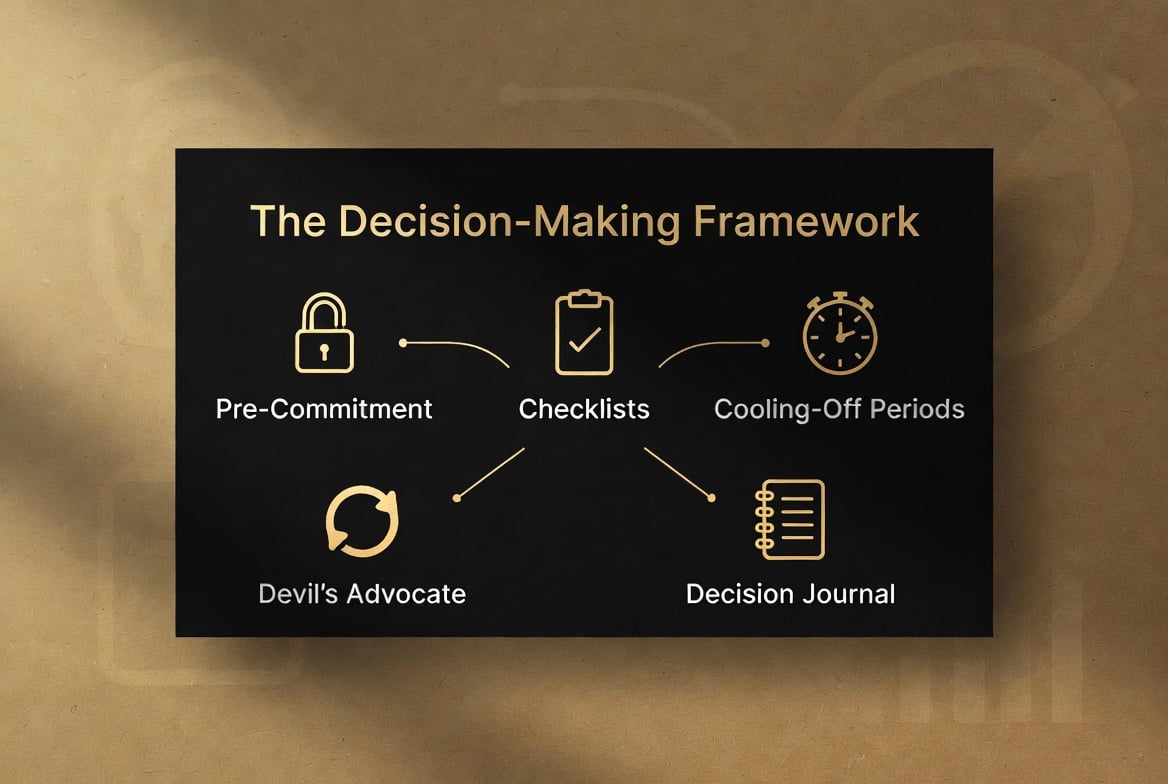

The Decision-Making Framework

How do you make better decisions under pressure? Not through willpower—willpower fails under stress. Through systems.

Strategy 1: Pre-Commitment

Make decisions before you need to make them.

Before every trade, document:

- Entry criteria (what makes this a valid trade?)

- Exit criteria (when do you get out, win or lose?)

- Position size (how much are you risking?)

- Invalidation (what would prove you wrong?)

When pressure hits, you don't decide. You execute what you already decided.

Strategy 2: Checklists

Checklists force System 2 to engage.

Before any trade:

- Does this match your setup criteria?

- Is your position size within your rules?

- Have you identified your stop loss?

- Are you in a good emotional state?

- Would you take this trade if you knew it would lose?

If any answer is "no," don't trade.

Strategy 3: Cooling-Off Periods

Never make important decisions immediately.

Implement rules:

- After a loss: Wait 15 minutes before the next trade

- After 3 consecutive losses: Stop trading for the day

- Before oversizing: Wait 24 hours

- Before breaking any rule: Write down why first

Time is the enemy of bad decisions.

Strategy 4: Devil's Advocate

Actively argue against yourself.

Before any trade, ask:

- What's the bear case?

- What would make this trade fail?

- What am I missing?

- What would a skeptic say?

If you can't argue the other side, you don't understand the trade well enough.

Strategy 5: Decision Journal

Track your decisions, not just your results.

For every trade, record:

- What was your emotional state?

- What was your reasoning?

- Did you follow your process?

- What would you do differently?

Review weekly. Patterns emerge that are invisible in the moment.

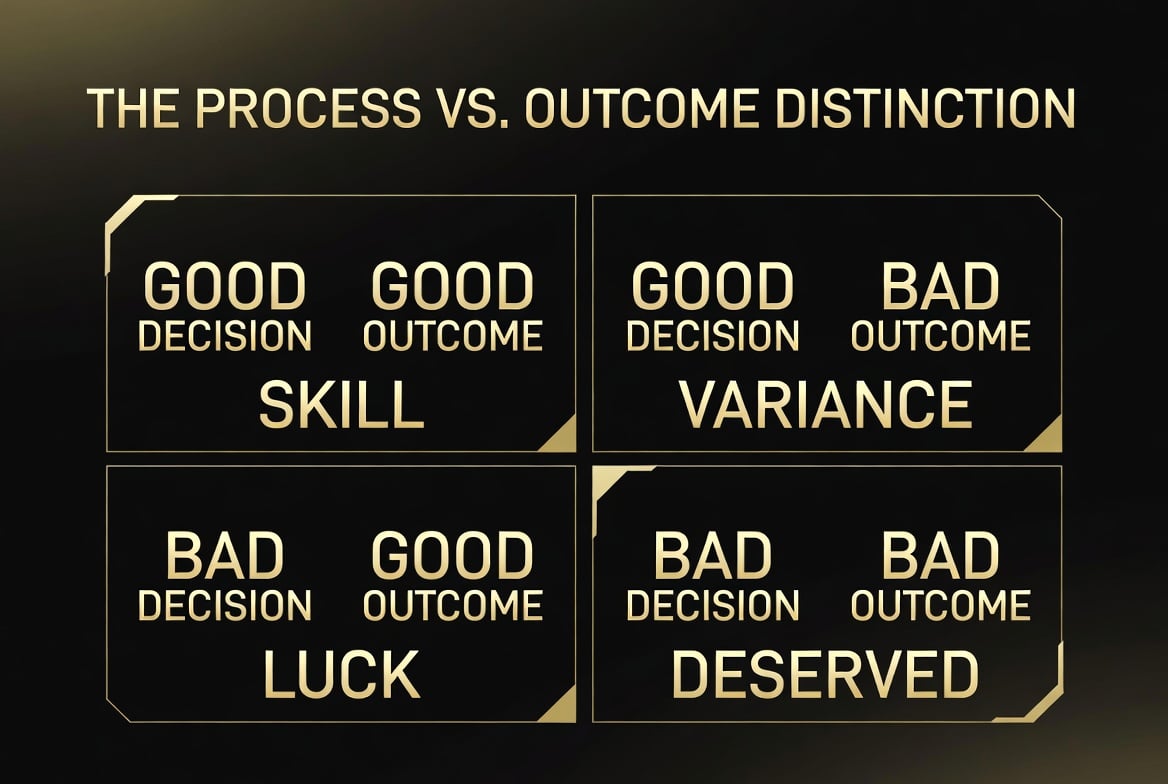

The Process vs. Outcome Distinction

Here's a crucial insight: a good decision can have a bad outcome, and a bad decision can have a good outcome.

If you follow your system perfectly and lose, that's a good decision with a bad outcome.

If you break all your rules and win, that's a bad decision with a good outcome.

"The investor's chief problem — and even his worst enemy — is likely to be himself." — Benjamin Graham

Most traders judge decisions by outcomes. This is a mistake. It reinforces bad habits when they happen to work and punishes good habits when they happen to fail.

Judge your decisions by your process. Did you follow your rules? Did you manage your risk? Did you make the decision rationally?

If yes, it was a good decision—regardless of the outcome.

Key Takeaways

Your brain has two systems. System 1 (fast, emotional) takes over under pressure, overriding System 2 (slow, rational).

Six biases sabotage traders. Confirmation bias, anchoring, recency bias, sunk cost fallacy, overconfidence, and hindsight bias.

You can't see your own biases. They feel like rational decisions in the moment. That's what makes them dangerous.

Willpower fails under pressure. Systems work. Pre-commitment, checklists, cooling-off periods, and devil's advocate thinking.

Judge process, not outcomes. A good decision can lose. A bad decision can win. Focus on whether you followed your rules.

Time is your ally. Most bad decisions are made quickly. Build in delays before important choices.

Document everything. Decision journals reveal patterns invisible in the moment.

Frequently Asked Questions

How do you know if you're making a biased decision?

The honest answer: you often can't tell in the moment. That's why biases are so dangerous—they feel like rational decisions. The best defense is systems: checklists, pre-commitments, and cooling-off periods that don't rely on you recognizing your own bias.

Can you train yourself to be less biased?

You can become more aware of biases, but you can't eliminate them. They're hardwired into human cognition. The goal isn't to be unbiased—it's to build systems that catch your biases before they affect your trading.

What's the most dangerous bias for traders?

Overconfidence, closely followed by confirmation bias. Overconfidence leads to oversizing and ignoring risk management. Confirmation bias keeps you in losing trades too long. Together, they're responsible for most blown accounts.

How do you stay calm under pressure?

You don't—not reliably. Instead, make your important decisions when you're calm (pre-commitment) and create rules that don't require calmness to follow (checklists, cooling-off periods).

Should you trust your intuition in trading?

Intuition is System 1. It can be valuable after years of experience, but it's unreliable under pressure. Use intuition to generate ideas, but use System 2 (analysis, checklists) to validate them before acting.

How long does it take to improve decision-making?

Most traders see improvement within 2-3 months of consistent system use. But decision-making is a lifelong practice. Even experienced traders must remain vigilant—biases don't disappear with experience.

Conclusion

Your brain will always try to sabotage you under pressure. This isn't a flaw—it's how human cognition works. The instincts that helped your ancestors survive are the same instincts that make you panic sell at bottoms and FOMO buy at tops.

You can't change your brain. But you can build systems that work despite it.

Pre-commit your decisions. Use checklists. Take cooling-off periods. Argue against yourself. Journal your decisions.

The best traders aren't the smartest. They're the ones who've learned to make good decisions when their brain is screaming at them to do the opposite.

Build your systems. Trust your process. And remember: under pressure, your brain lies to you.

Don't believe everything you think.

Related Articles: