Mental Health for Traders: Building a Sustainable Trading Career

Protect your mental health while trading. Learn to recognize burnout, manage trading stress, and build a sustainable trading life that lasts decades.

Profabighi Capital Research Team

January 14, 2026

Important Notice

This content is provided for informational and educational purposes only. It should not be considered as financial, investment, or trading advice.

Trading is a marathon, not a sprint. Yet many traders approach it like a sprint—grinding harder, trading more, sacrificing everything for short-term gains.

The result? Burnout. Anxiety. Damaged relationships. And often, damaged accounts.

This guide addresses the psychological costs of trading that nobody talks about—and provides practical strategies for building a trading career that lasts decades, not months.

The Hidden Costs of Trading

Trading extracts costs that don't appear on any P&L statement.

Constant Uncertainty

Most professions offer some predictability. You know roughly what you'll earn. You receive feedback on whether you're doing well.

Trading offers none of this. You can execute perfectly and lose money. You can make mistakes and profit. The uncertainty is relentless, and the human brain isn't designed for it.

Isolation

Trading is often a solitary activity. Hours spent alone, staring at screens, making decisions that affect your financial future. There's no team to celebrate wins with, no colleagues to process losses with.

This isolation compounds over time, especially for full-time traders who work from home.

Identity Fusion

When your income depends on trading, your identity starts merging with your results. A losing day feels like YOU are a loser. A winning day feels like YOU are a winner.

This is psychologically dangerous. Your worth as a human being has nothing to do with your trading performance.

Financial Stress

If trading is your primary income, every drawdown threatens your livelihood. This creates a destructive cycle: stress leads to poor decisions, poor decisions lead to losses, losses lead to more stress.

Screen Time

Hours staring at charts. Blue light exposure. Sedentary posture. Constant stimulation. The physical toll compounds the mental toll, affecting sleep, mood, and cognitive function.

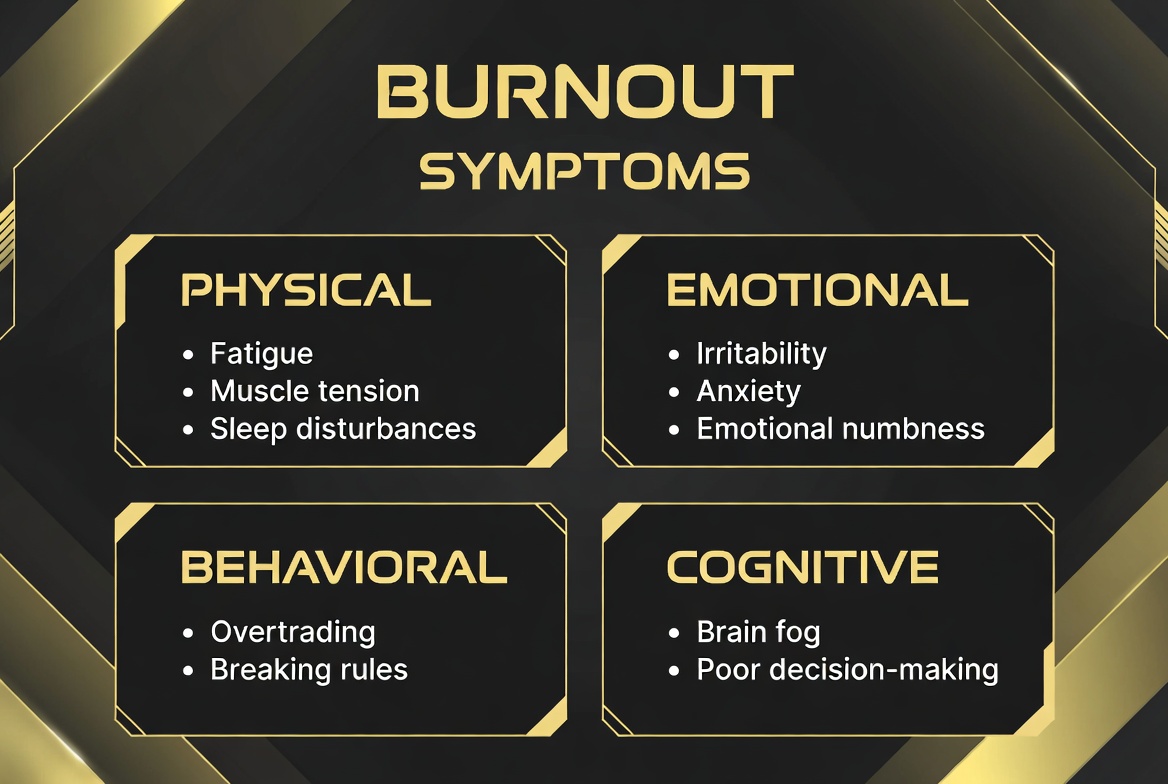

Recognizing Burnout

Burnout doesn't happen overnight. It develops gradually, often unnoticed until it's severe. Here are the warning signs:

Physical Symptoms

- Chronic fatigue that sleep doesn't resolve

- Tension headaches

- Sleep disturbances (insomnia or oversleeping)

- Changes in appetite

- Physical tension in shoulders, neck, or jaw

- Weakened immune system

Emotional Symptoms

- Irritability over minor issues

- Feeling detached or emotionally numb

- Persistent anxiety outside trading hours

- Loss of enjoyment in previously pleasurable activities

- Feelings of hopelessness or being trapped

- Mood swings

Behavioral Symptoms

- Overtrading (trading to feel something)

- Increasingly breaking your own rules

- Avoiding trading entirely

- Neglecting relationships and responsibilities

- Increased use of alcohol or other substances

- Social withdrawal

Cognitive Symptoms

- Difficulty concentrating

- Brain fog

- Deteriorating decision quality

- Negative self-talk

- Catastrophic thinking

- Memory problems

If you recognize several of these symptoms, take them seriously. Burnout is not a badge of honor—it's a signal that something needs to change.

Stress Management Strategies

Physical Strategies

Exercise: Even 20 minutes of movement changes brain chemistry. Walking, stretching, or light cardio all count. Make it non-negotiable.

Sleep: Sleep deprivation impairs decision-making as severely as alcohol intoxication. Prioritize 7-8 hours consistently.

Nutrition: Your brain requires proper fuel. Skipping meals or relying on caffeine and processed food affects cognitive function and mood.

Breaks: Step away from screens regularly. The 90-minute rule suggests taking a break every 90 minutes for optimal cognitive performance.

Mental Strategies

Meditation: Even 5-10 minutes daily reduces anxiety and improves focus. Guided meditation apps can help beginners establish a practice.

Journaling: Writing about thoughts and feelings creates psychological distance from them. It's accessible, free, and effective.

Professional Support: Working with a therapist, particularly one who understands performance psychology, provides tools and perspective that self-help cannot.

Boundaries: Define when trading ends and life begins. Close charts. Disable notifications. Protect non-trading time.

Social Strategies

Community: Connect with other traders who understand the unique challenges. Trading communities, online groups, or local meetups reduce isolation.

Non-Trading Relationships: Maintain friendships with people who don't care about your P&L. They remind you that you're more than a trader.

Accountability: Find someone who checks on your wellbeing, not just your trades.

Building a Sustainable Trading Life

Sustainability isn't about trading less—it's about trading in a way you can maintain for decades.

Work-Life Boundaries

Define your trading hours. When those hours end, trading ends. No checking charts during dinner. No analyzing positions at 2 AM.

This is challenging. Markets are always open somewhere. But you are not always open.

Practical implementation:

- Set specific start and end times

- Use separate devices for trading and personal life

- Create physical separation between trading space and living space

- Communicate boundaries to family and friends

Income Diversification

If 100% of your income depends on trading, every drawdown becomes an existential threat. Consider:

- Part-time work or consulting

- Passive income streams

- Savings buffer covering 6-12 months of expenses

This isn't about lacking confidence in your trading. It's about reducing the pressure that destroys trading performance.

Identity Diversification

You are not your P&L.

Cultivate identity outside trading:

- Hobbies unrelated to markets

- Relationships that don't depend on your success

- Goals that aren't financial

- Roles beyond "trader" (parent, friend, community member)

When trading is your entire identity, losses feel catastrophic. When trading is one part of a rich life, losses are just losses.

Long-Term Thinking

The goal isn't to maximize this month's P&L. It's to still be trading profitably in 20 years.

That requires protecting:

- Your capital

- Your mental health

- Your relationships

- Your physical health

Short-term gains mean nothing if you burn out in three years.

When to Step Back

Sometimes the healthiest decision is to stop trading—temporarily or permanently.

Signs you need a break:

- Trading is damaging your relationships

- You're experiencing persistent anxiety or depression

- Decision quality is consistently deteriorating

- You've lost all enjoyment

- Physical health is suffering

What a break looks like:

- Close all positions

- Step away from charts completely

- Set a specific return date

- Use the time to address underlying issues

- Return only when genuinely ready

A break isn't failure. It's maintenance. Even elite athletes have off-seasons.

Key Takeaways

Trading extracts hidden costs. Uncertainty, isolation, identity fusion, and financial stress take psychological tolls that don't appear on P&L statements.

Burnout develops gradually. Learn to recognize physical, emotional, behavioral, and cognitive warning signs before they become severe.

Sustainability is the edge. The goal isn't maximum short-term P&L—it's a trading career that lasts decades.

Protect your identity. You are not your P&L. Cultivate identity, relationships, and goals outside trading.

Boundaries are essential. Define when trading ends and life begins. Protect non-trading time fiercely.

Professional help is smart, not weak. Therapists and coaches provide tools and perspective that self-help cannot.

Breaks are maintenance, not failure. Sometimes stepping back is the healthiest and most profitable decision.

Frequently Asked Questions

Is it normal to feel anxious about trading?

Some anxiety is normal—trading involves real risk and uncertainty. However, persistent anxiety that affects sleep, relationships, or quality of life signals that something needs to change. Don't normalize suffering.

How do you know if you need professional help?

If symptoms persist for more than two weeks, affect daily functioning, or include thoughts of self-harm, seek professional help immediately. There's no shame in it—it's the intelligent response.

Can you be a successful trader and have good mental health?

Absolutely. In fact, good mental health improves trading performance. The best traders prioritize sustainability over short-term gains. Protecting your psychology is protecting your edge.

How do you explain trading stress to people who don't trade?

Focus on universal aspects: uncertainty, isolation, performance pressure. Most people understand job stress even if they don't understand markets. You don't need them to understand trading—you need them to understand you.

Should you quit trading if it's affecting your mental health?

Not necessarily, but something needs to change. That might mean taking a break, reducing position sizes, changing your trading style, or addressing underlying issues with professional help. Trading shouldn't cost you your health.

How do you balance trading ambition with mental health?

Redefine success. Success isn't maximum P&L—it's sustainable profitability over decades. That requires protecting your mental health. The most ambitious thing you can do is build a trading career that lasts.

Conclusion

Trading is genuinely hard—not just technically, but psychologically. The constant uncertainty, the isolation, the identity fusion with results—these take a toll that no strategy can prevent.

The most important edge in trading isn't a strategy or an indicator. It's sustainability. The ability to keep trading, year after year, without destroying yourself in the process.

Protecting your mental health isn't separate from your trading—it IS your trading. Burned out traders make bad decisions. Anxious traders overtrade. Depressed traders miss opportunities.

Your P&L doesn't define your worth. Your wellbeing matters more than any trade.

Please take care of yourself.

Future Articles:

- The Daily Trading Ritual: Building Routines That Stick

- The Discipline Equation: Systems Over Willpower

- The Stoic Trader Framework: Ancient Wisdom for Modern Markets

Connect With Us

- Website: profabighicapital.com

- Email: profabighicapital@gmail.com

- Twitter/X: @Profabighi

- Reddit: u/Profabighi_Capital

- Substack: @profabighicapital

- Instagram: @profabighicapital