Trading Risk Psychology: Why You Break Your Own Rules and How to Stop

Master trading risk psychology with our comprehensive guide. Learn why traders break their own rules and discover the R.I.S.K. Protocol for consistent risk management.

Profabighi Capital Research Team

December 10, 2025

Important Notice

This content is provided for informational and educational purposes only. It should not be considered as financial, investment, or trading advice.

You have the perfect position sizing formula. A spreadsheet that calculates everything. Kelly Criterion, ATR-based stops, the works.

And you still break your rules.

Here's a common scenario: You're on a five-trade winning streak. Confidence is through the roof. Then you see what looks like the "perfect" setup. Your rules say risk 1%. But this is different. This is a "sure thing."

You risk 5%.

Two hours later, you haven't just lost that trade. You've wiped out three weeks of careful, disciplined gains. The worst part? You knew better. You had the rules. You had the formulas. You had read all the books.

So why do traders break their own rules?

This question haunts every trader at some point. And the answer has nothing to do with trading systems. It has everything to do with trading risk psychology.

Understanding Loss Aversion in Trading

Here's the uncomfortable truth that most trading education ignores: your brain is not designed for trading.

Evolution optimized our minds for survival on the African savanna, not for navigating financial markets. The same instincts that kept our ancestors alive—fear of loss, desire for quick rewards, pattern recognition in randomness—are the exact instincts that destroy trading accounts.

Daniel Kahneman, the Nobel Prize-winning psychologist, discovered something profound about human decision-making. He called it Prospect Theory, and it explains why traders consistently make irrational risk decisions.

The core finding? Losses hurt approximately twice as much as equivalent gains feel good.

Think about that. A $1,000 loss doesn't just feel like the opposite of a $1,000 gain. It feels like losing $2,000. This asymmetry is hardwired into your brain.

"Losses loom larger than gains." — Daniel Kahneman

This loss aversion manifests in three destructive trading patterns:

Pattern 1: Taking Profits Too Early

You're up 2R on a trade. Your system says hold for 3R. But that voice in your head whispers: "Take the profit. Don't let it turn into a loss." So you close early. And then watch the trade hit your original target.

Pattern 2: Holding Losses Too Long

You're down 1R. Your stop is clear. But closing the trade means admitting you were wrong. So you move your stop. "Just a little more room." The 1R loss becomes 3R.

Pattern 3: Revenge Trading

After a loss, your brain screams for recovery. Not tomorrow. Now. So you take a suboptimal setup, oversized, trying to "get back" what the market "took" from you.

The market didn't take anything. You gave it away.

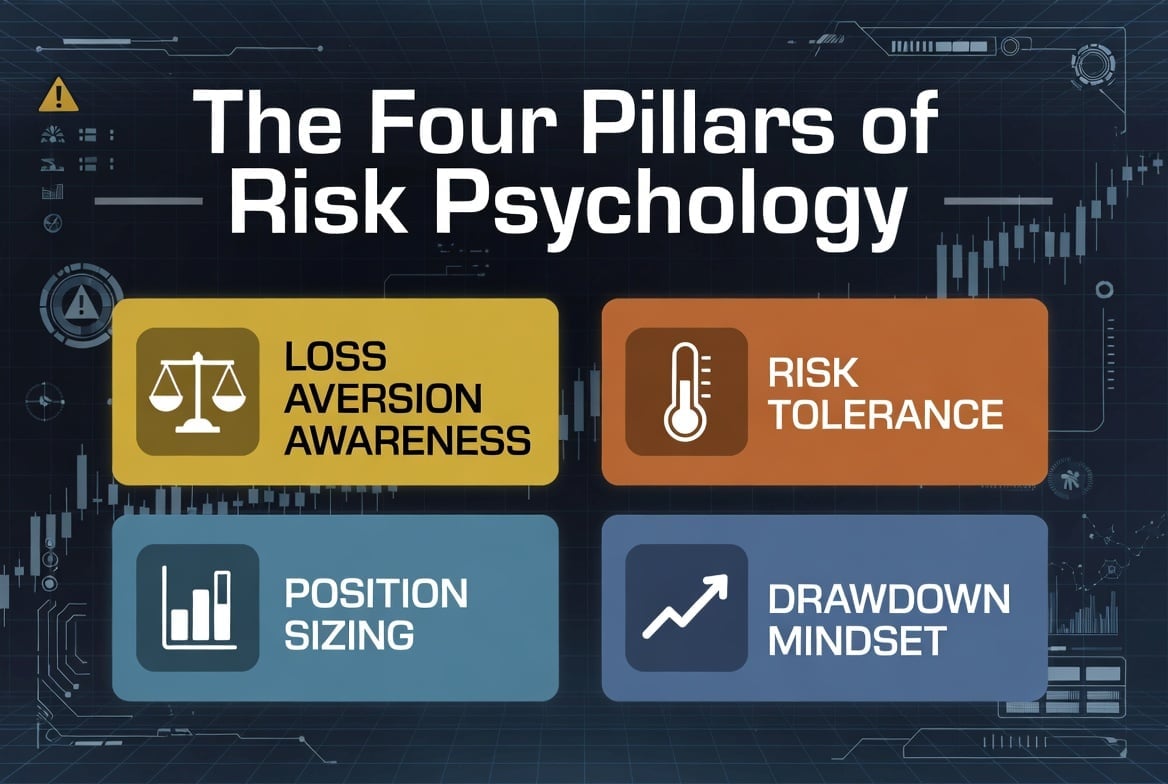

The Four Pillars of Risk Psychology

After studying hundreds of traders and their mistakes, four psychological pillars emerge that determine your relationship with risk.

Pillar 1: Loss Aversion Awareness

Loss aversion is the most powerful force in trading psychology. You cannot eliminate it—it's biological. But you can become aware of it and create systems that account for it.

The key insight: your brain will always try to avoid the pain of loss, even when that avoidance creates larger losses.

This is why traders:

- Cut winners short (fear of giving back gains)

- Let losers run (hope for recovery)

- Overtrade after losses (desperation to recover)

Pillar 2: Risk Tolerance Self-Assessment

Here's something most traders never consider: your risk tolerance is not fixed.

It changes based on:

- Your recent results (winning streak vs. losing streak)

- Your financial situation (bills due vs. comfortable)

- Your emotional state (stressed vs. calm)

- Time of day (morning clarity vs. afternoon fatigue)

- External factors (news, family, health)

The trader who risks 1% on Monday morning after a good weekend is not the same trader who risks 1% on Friday afternoon after a losing week.

The question isn't "What's my risk tolerance?"

The question is "What's my risk tolerance RIGHT NOW?"

Pillar 3: Position Sizing Psychology

You have a position sizing formula. Maybe it's 1% risk per trade. Maybe it's based on ATR. Maybe it's Kelly Criterion.

The formula doesn't matter if you don't follow it.

And here's when traders break their sizing rules:

After a winning streak: "I'm hot right now. Let me size up to maximize this run."

After a losing streak: "I need to make back my losses. One bigger trade will fix everything."

On "sure thing" setups: "This setup is so perfect, it deserves more size."

During FOMO: "This is moving without me. I need to get in NOW, full size."

Notice the pattern? Every justification for breaking your rules sounds reasonable in the moment. That's what makes it so dangerous.

Pillar 4: Drawdown Mindset

Every trader will experience drawdowns. This is not a possibility—it's a certainty.

The question is: How will you respond?

Consider this mathematical reality:

- 10% drawdown requires 11% gain to recover

- 20% drawdown requires 25% gain to recover

- 30% drawdown requires 43% gain to recover

- 50% drawdown requires 100% gain to recover

This is why protecting capital is more important than making money. A 50% drawdown doesn't just cut your account in half—it requires you to DOUBLE your remaining capital just to get back to even.

"It's not whether you're right or wrong that's important, but how much money you make when you're right and how much you lose when you're wrong." — George Soros

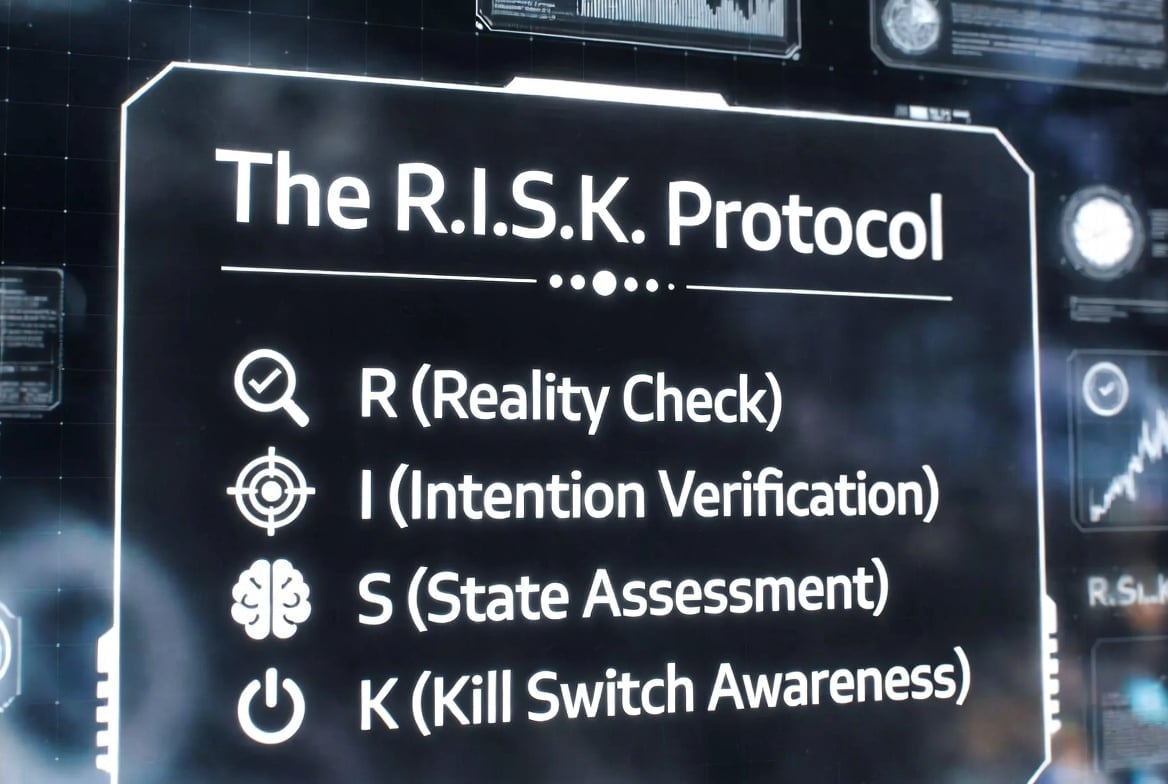

The R.I.S.K. Protocol: A Practical Framework

After years of research and application, a simple framework emerges that works before every trade. It's called the R.I.S.K. Protocol:

R - Reality Check

Before entering any trade, ask yourself:

- "Am I following my system, or am I improvising?"

- "Is this position size within my rules?"

- "Can I afford to lose this money without emotional impact?"

If any answer is "no" or "I'm not sure," don't take the trade.

I - Intention Verification

What is your intention for this trade?

- "To execute my system" ✅

- "To make back yesterday's losses" ❌

- "To prove I was right about this market" ❌

- "Because I'm bored and want action" ❌

Only one intention is valid. All others are psychological traps.

S - State Assessment

Check your current state:

- Physical: Am I tired, hungry, or unwell?

- Emotional: Am I angry, anxious, or overconfident?

- Mental: Am I focused, or distracted by other concerns?

Trading in a compromised state is like driving drunk. You might get away with it sometimes, but eventually, it catches up with you.

K - Kill Switch Awareness

Before entering, know your exit:

- Where is my stop loss? (Exact price)

- What would make me exit early? (Invalidation criteria)

- What is my maximum daily loss? (When do I stop trading?)

If you can't answer these questions clearly, you're not ready to trade.

Daily Implementation Guide

Morning Routine (Before Market Open)

- State Check: Rate your physical, emotional, and mental state 1-10

- Rule Review: Read your top 3 risk rules out loud

- Intention Setting: Write down your trading intention for the day

- Maximum Loss: Confirm your daily loss limit

During Trading

- Pre-Trade Pause: Run R.I.S.K. Protocol before every entry

- Position Size Verification: Double-check size matches your rules

- Emotional Monitoring: If you feel strong emotion, step away for 5 minutes

- No Exceptions: The "just this once" exception is how accounts blow up

Evening Review

- Rule Compliance: Did you follow your risk rules today?

- Emotional Triggers: What emotions did you experience? What triggered them?

- Lessons Learned: What would you do differently?

- Tomorrow's Preparation: Any adjustments needed?

Common Mistakes to Avoid

Mistake 1: Thinking You're Different

"I understand loss aversion, so it won't affect me."

Reality: Understanding a bias doesn't eliminate it. You need systems and checklists, not just knowledge.

Mistake 2: Relying on Willpower

"I'll just be more disciplined next time."

Reality: Willpower is a depleting resource. Systems beat willpower every time.

Mistake 3: Ignoring Emotional State

"My emotions don't affect my trading."

Reality: If you're human, your emotions affect your trading. The question is whether you're aware of it.

Key Takeaways

Loss aversion is biological, not a character flaw. You can't eliminate it, but you can work with it.

Your risk tolerance changes constantly. Check your state before every trading session.

Position sizing rules only work if you follow them. The "just this once" exception is how accounts blow up.

Drawdowns are inevitable. Your response to them determines your long-term success.

Consistency beats optimization. A "suboptimal" risk approach you follow is better than a "perfect" approach you break.

Use the R.I.S.K. Protocol. Reality Check, Intention Verification, State Assessment, Kill Switch Awareness.

Systems beat willpower. Create checklists and rules that remove the need for in-the-moment decisions.

Frequently Asked Questions

How long does it take to develop better risk psychology?

Risk psychology improvement is a continuous journey, not a destination. Most traders see meaningful improvement within 3-6 months of consistent practice with frameworks like the R.I.S.K. Protocol. However, even experienced traders must remain vigilant—old patterns can resurface during stressful periods.

Can risk psychology techniques work for all types of traders?

Yes, the principles of risk psychology apply to all traders regardless of timeframe, asset class, or strategy. Whether you're a day trader, swing trader, or long-term investor, loss aversion and emotional decision-making affect everyone. The specific implementation may vary, but the core concepts are universal.

What's the most common mistake when trying to improve risk management?

The most common mistake is relying on willpower instead of systems. Traders often say "I'll be more disciplined next time" without creating concrete rules and checklists. Willpower depletes throughout the day and fails under stress. Systems and pre-defined rules work when willpower doesn't.

How do you know if you're making progress with risk psychology?

Track your rule compliance, not just your P&L. Progress looks like: following your position sizing rules even when you want to break them, stepping away when you recognize emotional triggers, and having fewer "I knew better" moments. Keep a journal specifically for risk rule compliance.

Should you reduce your position size when on a losing streak?

This depends on your system, but generally yes—not because of the math, but because of psychology. During losing streaks, emotional decision-making increases. Reducing size gives you more room for error while you work through the psychological challenges. Once you're back to consistent rule-following, you can return to normal sizing.

How do you handle the urge to revenge trade after a loss?

The R.I.S.K. Protocol's Intention Verification step is specifically designed for this. Before any trade after a loss, ask: "Why am I taking this trade?" If the honest answer involves recovering losses, step away. Set a rule: no trading for 30 minutes after a loss, or limit yourself to one trade per hour during drawdowns.

Is it possible to completely eliminate emotional trading?

No, and that's not the goal. Emotions are part of being human. The goal is to create systems that prevent emotions from driving trading decisions. You'll still feel fear, greed, and frustration—but with proper frameworks, you won't act on them impulsively.

Conclusion

Trading risk psychology is the hidden edge that separates consistent traders from those who blow up their accounts. You can have the perfect strategy, the best indicators, and years of experience—but if you don't understand why you break your own rules, none of it matters.

The good news? Risk psychology is a skill that can be developed. It requires awareness, systems, and consistent practice. The R.I.S.K. Protocol is one tool among many, but the principle remains the same: create structures that work when your emotions don't.

Start small. Run the checklist before your next trade. Track your emotional state. Notice when you want to break your rules, and ask yourself why.

The win isn't the trade. The win is following your rules.

Related Articles

- Trading Journal Mastery: The Psychology Behind Effective Trade Logging

- The Discipline Equation: Building Systematic Trading Habits

- Fear and Greed in Trading: Recognition and Management

- The Daily Trading Ritual: Building Routines That Stick

- The Stoic Trader Framework: Ancient Philosophy for Modern Markets